Why did vSphere nearly become more expensive than RHEV 5 times?

Over the past few weeks, something strange has happened to VMware. At first, they unexpectedly changed the vSphere 5 licensing scheme, and then revised it , softening some conditions. However, it’s not so much the new licensing model itself that is interesting, but the reasons for such variability. Under the cut, I will try to analyze the current state and prospects of the virtualization market.

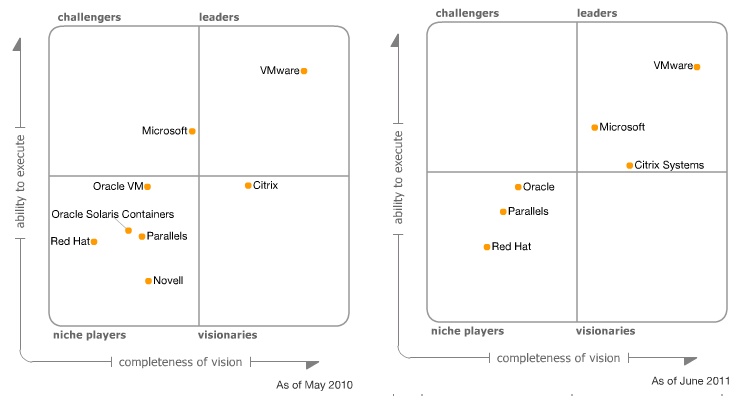

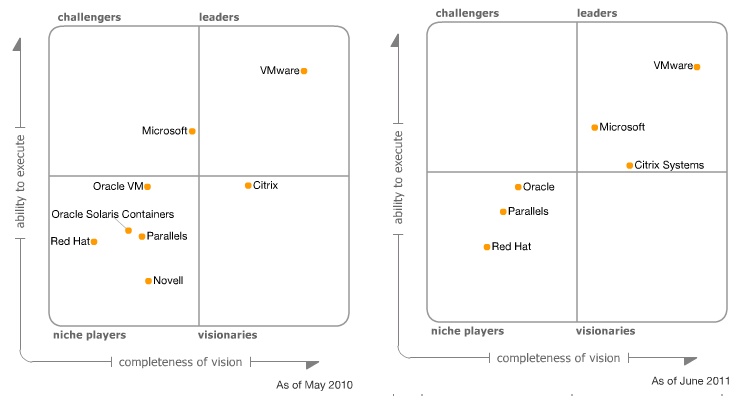

So, what could be the reason for such a sharp price increase? Let's look at the recently published Gartner report and compare with what was a year ago:

')

In just one year, Citrix and Microsoft moved to the leaderboard quadrant, their separation from VMware is shrinking faster and faster. More competitive conditions greatly reduce the cost of virtualization, each of the vendors represented on the Gartner Magic Quadrant, in one form or another, has (almost) free products and this, in my opinion, is most worried about VMware. The company is looking at the “collapsing” market and understand that it is necessary to squeeze out everything possible from it as soon as possible.

This report was not a discovery for those who follow the virtualization market. My personal opinion is that the inconsistent pricing policy of VMware reflects the panic that prevails in the company's management. Everyone understands that VMware will not be able to maintain unconditional market leadership for more than two years, during this time you need to “dig in” as much as possible, complicate the transition to competing products and get as much money from your customer base.

Now VMware is doing more than successfully , but as soon as the growth rate slows down, top managers, let's say softly, will feel pressure from shareholders. And the growth rate will decrease necessarily. Let's look for a couple of years into the future, I see three very clear threats to the entire VMware business. (I emphasize that these are not reflections on the current situation, but on what I would be afraid of at the place of the top management of VMware in the coming years. And yes, this is just IMHO, it may be wrong. ;-))

1) Oracle VM.

Today, Oracle is almost unnoticeable in the virtualization market, but it has good potential - three products were immediately in the hands of Oracle: Sun xVM, Oracle VM, and Virtual Iron (all based on Xen). Of course, if Oracle takes the virtualization seriously, it will be intercepted from VMware in the first place by those who are using other Oracle products and / or their (Sun) hardware. And these are the largest and most solvent customers.

Will VMware find arguments for deterring the migration of those using the full Oracle stack? Even with the fact that VMware products will be more functional, efficient and cheap, Oracle will only have to say about seamless integration and optimization of Oracle VM under their DBMS or ERP to “bite off” a noticeable piece of the market.

2) Microsoft Hyper-V

If Oracle can lead away the most solvent customers, then Microsoft will most likely take away customers from small and medium businesses. And here, too, there are few options to avoid negative developments - there are so many ... let's say, Windows administrators who do not want to learn anything other than Microsoft products.

And do not forget that Hyper-V is part of the Windows Server, so I think it makes no sense to compete in this segment, for VMware. Paul Maritz, head of VMware, worked for 14 years as a top manager at Microsoft, so there is no doubt that he knows their techniques and policies very well.

3) Open Virtualization Alliance and OpenStack.

If the upper and lower segments of the market can be “eaten” by, respectively, Oracle and MS, then on average, most likely, there will be not a single product, but a common platform. The most likely options are the OpenStack and Open Virtualization Alliance. In both cases, the main threat is that open solutions are being promoted, respectively, the threshold for entering the market is very low, which, by the way, has been used by many companies (92 participants in OpenStack and 102 in OVA).

However, participating in OVA and OpenStack are not small companies - Intel, HP, Dell ... By the way, the two organizations mentioned above do not compete with each other, but complement each other, OpenStack promotes IaaS, and OVA - the hypervisor. They, in theory, can work together and just together the most dangerous for VMware. Although today OpenStack is a niche solution, it has very serious administrative support . And the difficulty is that VMware will have to compete with many companies at once.

Where is Citrix?

Perhaps someone wonders why I did not find Citrix among the threats of VMware. In fact, I counted it, but in the 3rd category, among the “other” companies (by the way, it is included in OpenStack). Why? It's simple - despite the fact that today Citrix positions are not very bad , it does not make sense to rank it alongside Oracle and Microsoft - Citrix has much less opportunity to invest in virtualization.

Moreover, there is an opinion that Citrix missed a bit with the purchase of XenSource in 2007. They expected to quickly become the “second VMware” and get a “cash cow”, and not to invest resources in technology development for years. Frankly, it’s not very clear how long Citrix will be able to stay in the top three leading companies, given the fierce competition in this market and their long-standing, close partnership with Microsoft.

But back to the question posed in the topic of the post ...

According to the aforementioned Garner report, the penetration of virtualization into server systems by 2015 will increase fivefold (as compared to 2010) and will reach 75%. Thus, on the one hand, there is an active growth of the market, and on the other hand, VMware's separation from competitors is decreasing. From the business point of view of VMware, now is the best time to raise prices. In my last post was such a comment:

What made VMware change its mind? I do not know, maybe the reaction of the market. And not outrage in blogs and forums, but “vote with their feet.” I recently went to a friend of mine and dragged an interesting piece of paper from him (scan attached below). He has already lost relevance, but reflects well what has been happening lately. Incredibly, just a couple of weeks was enough for potential customers to seriously consider other offers. And the reason for this was not so much the fact of price change, but the realization that it could increase again at any moment . Moreover, it will certainly increase, given the situation on the virtualization market.

So, what could be the reason for such a sharp price increase? Let's look at the recently published Gartner report and compare with what was a year ago:

')

In just one year, Citrix and Microsoft moved to the leaderboard quadrant, their separation from VMware is shrinking faster and faster. More competitive conditions greatly reduce the cost of virtualization, each of the vendors represented on the Gartner Magic Quadrant, in one form or another, has (almost) free products and this, in my opinion, is most worried about VMware. The company is looking at the “collapsing” market and understand that it is necessary to squeeze out everything possible from it as soon as possible.

This report was not a discovery for those who follow the virtualization market. My personal opinion is that the inconsistent pricing policy of VMware reflects the panic that prevails in the company's management. Everyone understands that VMware will not be able to maintain unconditional market leadership for more than two years, during this time you need to “dig in” as much as possible, complicate the transition to competing products and get as much money from your customer base.

Now VMware is doing more than successfully , but as soon as the growth rate slows down, top managers, let's say softly, will feel pressure from shareholders. And the growth rate will decrease necessarily. Let's look for a couple of years into the future, I see three very clear threats to the entire VMware business. (I emphasize that these are not reflections on the current situation, but on what I would be afraid of at the place of the top management of VMware in the coming years. And yes, this is just IMHO, it may be wrong. ;-))

1) Oracle VM.

Today, Oracle is almost unnoticeable in the virtualization market, but it has good potential - three products were immediately in the hands of Oracle: Sun xVM, Oracle VM, and Virtual Iron (all based on Xen). Of course, if Oracle takes the virtualization seriously, it will be intercepted from VMware in the first place by those who are using other Oracle products and / or their (Sun) hardware. And these are the largest and most solvent customers.

Will VMware find arguments for deterring the migration of those using the full Oracle stack? Even with the fact that VMware products will be more functional, efficient and cheap, Oracle will only have to say about seamless integration and optimization of Oracle VM under their DBMS or ERP to “bite off” a noticeable piece of the market.

2) Microsoft Hyper-V

If Oracle can lead away the most solvent customers, then Microsoft will most likely take away customers from small and medium businesses. And here, too, there are few options to avoid negative developments - there are so many ... let's say, Windows administrators who do not want to learn anything other than Microsoft products.

And do not forget that Hyper-V is part of the Windows Server, so I think it makes no sense to compete in this segment, for VMware. Paul Maritz, head of VMware, worked for 14 years as a top manager at Microsoft, so there is no doubt that he knows their techniques and policies very well.

3) Open Virtualization Alliance and OpenStack.

If the upper and lower segments of the market can be “eaten” by, respectively, Oracle and MS, then on average, most likely, there will be not a single product, but a common platform. The most likely options are the OpenStack and Open Virtualization Alliance. In both cases, the main threat is that open solutions are being promoted, respectively, the threshold for entering the market is very low, which, by the way, has been used by many companies (92 participants in OpenStack and 102 in OVA).

However, participating in OVA and OpenStack are not small companies - Intel, HP, Dell ... By the way, the two organizations mentioned above do not compete with each other, but complement each other, OpenStack promotes IaaS, and OVA - the hypervisor. They, in theory, can work together and just together the most dangerous for VMware. Although today OpenStack is a niche solution, it has very serious administrative support . And the difficulty is that VMware will have to compete with many companies at once.

Where is Citrix?

Perhaps someone wonders why I did not find Citrix among the threats of VMware. In fact, I counted it, but in the 3rd category, among the “other” companies (by the way, it is included in OpenStack). Why? It's simple - despite the fact that today Citrix positions are not very bad , it does not make sense to rank it alongside Oracle and Microsoft - Citrix has much less opportunity to invest in virtualization.

Moreover, there is an opinion that Citrix missed a bit with the purchase of XenSource in 2007. They expected to quickly become the “second VMware” and get a “cash cow”, and not to invest resources in technology development for years. Frankly, it’s not very clear how long Citrix will be able to stay in the top three leading companies, given the fierce competition in this market and their long-standing, close partnership with Microsoft.

But back to the question posed in the topic of the post ...

According to the aforementioned Garner report, the penetration of virtualization into server systems by 2015 will increase fivefold (as compared to 2010) and will reach 75%. Thus, on the one hand, there is an active growth of the market, and on the other hand, VMware's separation from competitors is decreasing. From the business point of view of VMware, now is the best time to raise prices. In my last post was such a comment:

vSphere 5 can cost as much as you want, we will use it anyway.I think that this is not a rare opinion and marketers of VMware, of course, know about it. And it was, in my opinion, that caused the initial licensing scheme of vSphere 5.

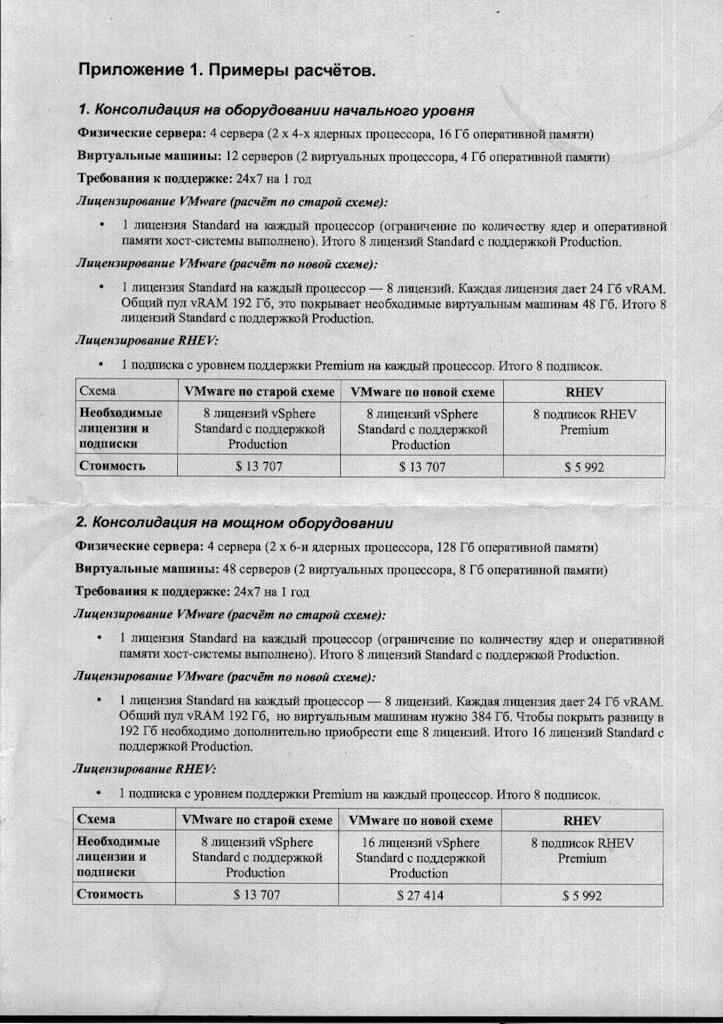

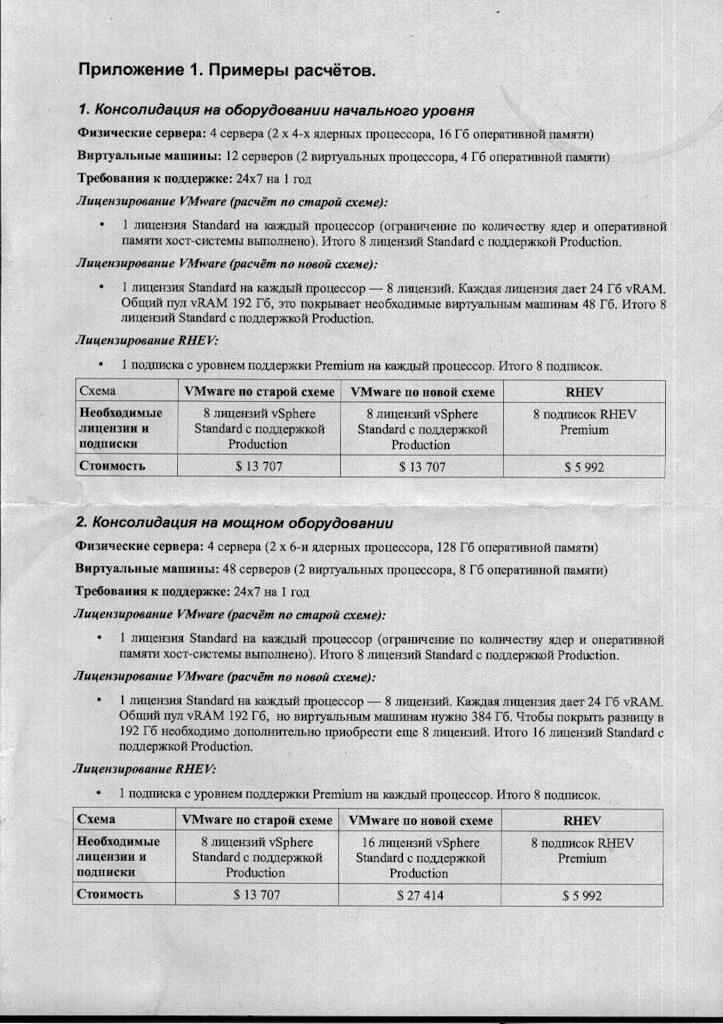

What made VMware change its mind? I do not know, maybe the reaction of the market. And not outrage in blogs and forums, but “vote with their feet.” I recently went to a friend of mine and dragged an interesting piece of paper from him (scan attached below). He has already lost relevance, but reflects well what has been happening lately. Incredibly, just a couple of weeks was enough for potential customers to seriously consider other offers. And the reason for this was not so much the fact of price change, but the realization that it could increase again at any moment . Moreover, it will certainly increase, given the situation on the virtualization market.

Source: https://habr.com/ru/post/125748/

All Articles