Apple's financial reserves exceeded US government operating reserves

As you know, the financial reserves of the US government are rapidly melting, which threatens with a technical default in the coming days: the country has a stable negative balance of payments, so it can only fill up the reserves by “printing” new money. However, the Congress has not yet given permission for this (in general, the degree of idiocy of politicians is difficult to overestimate).

As a result, a merry situation has developed that, as of yesterday (Thursday), the volume of operational reserves of the US Treasury fell to a level of $ 73.77 billion . This is less than what is at the disposal of Apple, whose reserves in June rose to $ 75.88 billion.

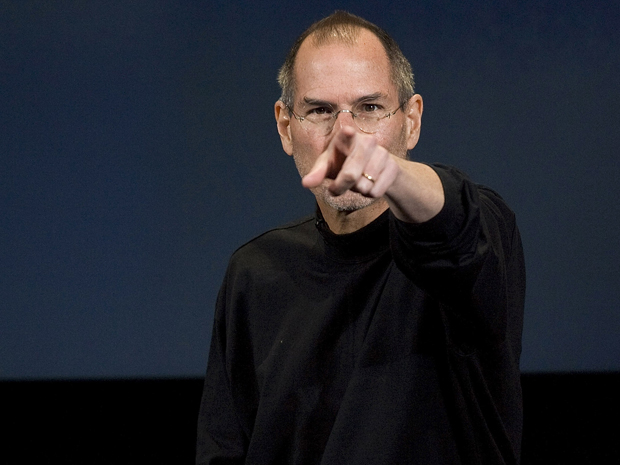

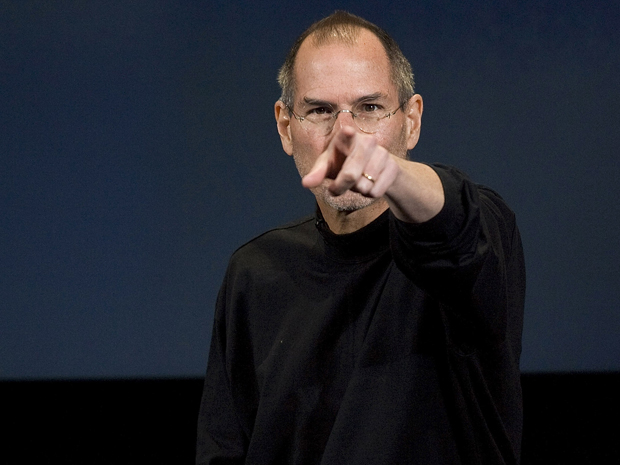

“Steve Jobs is now more liquid than Uncle Sam,” scoffs the Financial Post , enclosing the appropriate illustration.

')

Of course, the above figures cannot be directly compared, because they are completely different budgets that are filled with different methods and spent on different goals. Moreover, the United States can alwaysprint lend itself any amount without the threat of inflation (the privilege of issuers of world currency). However, such a comparison makes it possible to feel the enormous financial strength that the empire of Steve Jobs has accumulated.

Source: AppleInsider

IT-market experts have long argued why Apple has such huge cash reserves. Among the versions is insurance in case of the loss of some very large patent claim. For example, if the company is forced to pay license fees from each sold "iPhone". Alternatively, the reserves can be used to buy up competitors (for example, they can easily buy the same Nokia) or you can build a dozen or two of your own data centers and plants for the production of processors, LCD panels, memory, and so on.

Shareholders, of course, call to distribute part of the accumulated reserves in the form of dividends. But Steve Jobs is unmoved and says that "this is money for important strategic decisions."

As a result, a merry situation has developed that, as of yesterday (Thursday), the volume of operational reserves of the US Treasury fell to a level of $ 73.77 billion . This is less than what is at the disposal of Apple, whose reserves in June rose to $ 75.88 billion.

“Steve Jobs is now more liquid than Uncle Sam,” scoffs the Financial Post , enclosing the appropriate illustration.

')

Of course, the above figures cannot be directly compared, because they are completely different budgets that are filled with different methods and spent on different goals. Moreover, the United States can always

Source: AppleInsider

IT-market experts have long argued why Apple has such huge cash reserves. Among the versions is insurance in case of the loss of some very large patent claim. For example, if the company is forced to pay license fees from each sold "iPhone". Alternatively, the reserves can be used to buy up competitors (for example, they can easily buy the same Nokia) or you can build a dozen or two of your own data centers and plants for the production of processors, LCD panels, memory, and so on.

Shareholders, of course, call to distribute part of the accumulated reserves in the form of dividends. But Steve Jobs is unmoved and says that "this is money for important strategic decisions."

Source: https://habr.com/ru/post/125219/

All Articles