Why I do not use the payment aggregator ...

Paying for purchases on the site is a necessary attribute of any good online store. This is not just a rule of good tone, it is a significant increase in speed. There are many payment methods in Runet - Yandex.Money, Qiwi, WebMoney, RBK Money, as well as bank cards, mobile phone accounts, SMS micropayments, etc. How to give buyers the opportunity to pay for purchases in your favorite way?

Paying for purchases on the site is a necessary attribute of any good online store. This is not just a rule of good tone, it is a significant increase in speed. There are many payment methods in Runet - Yandex.Money, Qiwi, WebMoney, RBK Money, as well as bank cards, mobile phone accounts, SMS micropayments, etc. How to give buyers the opportunity to pay for purchases in your favorite way?For our service, we decided not to bother and used the services of a single payment aggregator. But with the growth has accumulated a large number of comments. It became clear that the aggregator is a temporary solution, and sooner or later it will have to be abandoned.

Then we tried to approach the task independently and understand in which cases it is worth using payment aggregators, and in which cases it makes sense to refuse their services.

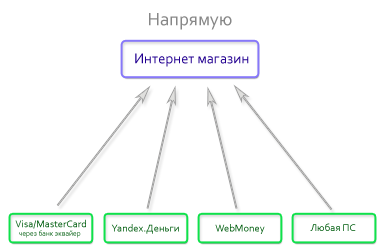

If you were engaged in connecting payments to the store or to your project, you know that you can organize payment for yourself in two fundamentally different ways - all through an intermediary and all directly. Here we consider these two payment system connection schemes and try to compare the advantages and disadvantages that they have. So, you can accept payments:

- Through an intermediary - a payment aggregator;

- Directly by connecting to the necessary payment systems.

')

Both approaches have their pros and cons. For a start, let's see what exactly intermediaries offer us when accepting payments. Typically, the sites of payment aggregators painted a large number of advantages. But, in general, it turns out to highlight 4 main points, which are the basis of the proposal of any of them:

- "Minimization of financial and time costs when connecting"

This item implies that in order to start accepting all payment systems, you need to conclude only one contract and implement only one software interface on your site. - "Reliability"

This refers to the high uptime of the aggregator servers and the protection of user data from being hit by third parties. - “Protection against fraud”

One of the functions of payment aggregators is to protect you from all sorts of scams on the Internet. This mainly concerns operations with bank cards. - "Various payment methods"

After going to the mediator's page, the buyer has the opportunity to choose a payment system from a large list. It is possible that among them the client will find his usual method of payment.

"Minimization of financial and time costs when connecting"

This is an undoubted advantage of any payment aggregator. Indeed, you need to use only one protocol and you will have to enter into a contract with only one organization. At this point, you can really save a lot of time and effort. For companies that are just starting to sell on the Internet, the use of payment aggregators looks like a rational step thanks to this item.But it should be noted that in many cases, for accepting cards, you still have to conclude an Internet acquiring agreement with the bank .

Summary: the use of payment aggregators, allows you to quickly start accepting payments with minimal connection costs.

"Reliability"

Typically, aggregators provide good uptime of their servers and high reliability when working with them. But in any case, the servers of payment aggregators are an additional node when receiving payments, which means that reliability in comparison with direct connection loses.A well-known saying says that you should not put all your eggs in one basket. Therefore, it is somewhat dangerous to let all your financial flow through one channel. The owner of the online store can figure out what losses the company will suffer if the aggregator server unexpectedly falls, despite the slogans. Or, for example, the intermediary will delay the payment of accepted payments - all income from sales of our goods is with him!

Summary: work with the use of intermediaries adds an additional node that is not under our control to the system, which means that reliability does not improve.

“Protection against fraud”

Many have heard that paying a credit card online is dangerous, that there are many different types of card fraud, and that the risks in this case lie on the store. But there is no understanding of whether the devil is really terrible, how it is painted. Let's try to figure out what fraudsters can do to us.

Many have heard that paying a credit card online is dangerous, that there are many different types of card fraud, and that the risks in this case lie on the store. But there is no understanding of whether the devil is really terrible, how it is painted. Let's try to figure out what fraudsters can do to us.Card payments have two features. First, the perfect payment can be withdrawn. Secondly, the transaction itself does not require the card itself, only its details are needed.

From here two most widespread schemes of swindle follow:

- I received the product / service, then I canceled my payment in the bank. But I already have the goods!

- I stole someone's card or its details and began to make purchases from it.

Technically, the processing of payments from plastic cards occurs in special software and hardware complexes - processing centers. Visa / Mastercard imposes very strict security requirements on these centers ( PCI DSS standard). Not all banks have the ability to accept payments by plastic cards on the Internet. Those who do this are called acquirers. They usually have their own processing centers.

There are many methods of dealing with fraudulent transactions (“fraud”) - these are also preventive methods, such as confirming possession of a card, white- and black-sheets of cards, ip-addresses, and checking after the fact. For example, analyzes the amount of purchases, the frequency of payments, from where the payments were made. A quick post factum check allows you to cancel a payment before the attacker tries to get the goods. Acquiring banks implement such functionality in their own - it’s profitable for them to make their clients feel protected. Thus, the acquiring bank will have to deal with fraud and reduce the possible damage from it. Aggregators do their additional checks in addition to banking.

To understand how real the threat is, and what financial losses it may entail, it is necessary to assess the extent of the fraud. When trying to determine how many fraud operations are performed, what are the volumes of these operations and how well the processing centers deal with them, nothing concrete can be found in runet. Therefore, we had to seek help from foreign sources (require registration), who say that in 2010 fraudulent operations caused damage to 0.9% of turnover. And there is a clear tendency to decrease in this indicator.

To understand how real the threat is, and what financial losses it may entail, it is necessary to assess the extent of the fraud. When trying to determine how many fraud operations are performed, what are the volumes of these operations and how well the processing centers deal with them, nothing concrete can be found in runet. Therefore, we had to seek help from foreign sources (require registration), who say that in 2010 fraudulent operations caused damage to 0.9% of turnover. And there is a clear tendency to decrease in this indicator.Both banks and aggregators have departments for tracking fraud operations. True, the aggregators take an additional 1-2% of your turnover, which, by the way, is certainly more than the potential losses. In addition, they still do not fully protect against refund .

Visa / MasterCard is also quite intensively working towards reducing fraud transactions. The fruit of their work is 3DSecure technology. Its meaning is to use three-domain authorization. When paying, the client must enter an additional password on the website of the bank that issued the card (issuing bank). Its main advantage is that when using these protocols, responsibility for possible financial losses falls on the card issuing bank. For the store, this means that even if the payment is recognized as fraud, the store will not lose anything .

Summary: the aggregators do not do anything fundamentally new, which would not be done by the acquiring banks for them, and at the same time they take additional interest on turnover for their “services”. Firstly, it causes direct losses to the business, and secondly, it is obviously greater than the size of the possible losses from fraudulent transactions.

"Various payment methods"

The number of payment methods offered by payment aggregators is impressive. I can argue that about 90% of them you did not even hear. But do not forget about the comfort of users. Convenient should be not only the ability to choose from dozens of currencies, but also the process of payment. Here the situation is also not in favor of the aggregators. Indeed, in the case of an intermediary, at least one additional transition to a page with an incomprehensible interface and design arises (someone goes further and needs to enter an e-mail, register, etc.). All this frightens the client a lot, and often gives the payment process a terribly confusing look. By the way, at one conference I heard the opinion that adding an extra click to the interface reduces the number of users who have mastered the task, e again :)

Here the situation is also not in favor of the aggregators. Indeed, in the case of an intermediary, at least one additional transition to a page with an incomprehensible interface and design arises (someone goes further and needs to enter an e-mail, register, etc.). All this frightens the client a lot, and often gives the payment process a terribly confusing look. By the way, at one conference I heard the opinion that adding an extra click to the interface reduces the number of users who have mastered the task, e again :)An important factor when paying is how the page looks like, where the customer is asked to drive in their payment details (one of the ways to steal cards is fake payment pages). A cautious client keeps an eye on where they enter their card details. And if the payment page does not seem to be sufficiently reliable, it will change its mind about paying (I, personally, trust only the pages of banks and large foreign stores).

Summary: The payment process using payment aggregators has a large selection of payment systems, but is very complicated, often inconvenient, and can scare some customers away.

Total

Small or novice stores may well decide for themselves that the unification and low connection costs outweigh all the disadvantages of the aggregators. But an online store with good turnover is guaranteed to lose dozens, if not hundreds, thousands of rubles per month on an additional commission of the aggregator. And if you still remember that paying a customer is not always convenient, then the question “whether you can connect directly without an aggregator” becomes relevant. So at what speed it is definitely worth to abandon the aggregator and connect directly to the payment systems?We estimate the top costs for connecting all payment systems. Suppose we want to connect all possible payment systems, including bank cards through an acquiring bank. We will want to implement all the interfaces, test everything, pay for all possible costs of negotiations, courier work, etc. We roughly estimated our costs in the amount of about 100 thousand. There is a lot of controversy about this figure, but in any case, the order remains so. From the same considerations, it is possible to estimate that the connection to the aggregator will cost several times less.

Suppose we are no longer the smallest company, and through the Internet we have thousands of $ 100 per month. Then two percent is 60 thousand rubles. It means that the savings in the commission will pay back our entire event in two months and begin to make a profit. And the appearance of high-quality reliable payment, which will be trusted by buyers, will increase the conversion of visitors into buyers and our turnover.

From this we can conclude that for a good store connection to payment systems is directly economically justified . One thing I can say for sure, if we had thought about it earlier, we would have connected to everyone without a mediator a long time ago.

PS

The article is largely subjective , it is based on our experience and our results of the analysis of the situation on the market of payment systems. I am sure that the observations and experience of the community will help clarify the conclusions and make the article more accurate, so I invite everyone to the discussion!

Source: https://habr.com/ru/post/124668/

All Articles