How much is Zynga for the people?

While most of the audience Habra is trying to get an invite to Google Plus + or make a first impression about the work of this social network (for lack of a better term, you have to call this service exactly), I suggest a little distract from photos, circles and video chats, looking at less interesting, and perhaps even more actively-swirling area today, which is widely covered in the open spaces of the entire Internet - the IPO of Internet companies.

While most of the audience Habra is trying to get an invite to Google Plus + or make a first impression about the work of this social network (for lack of a better term, you have to call this service exactly), I suggest a little distract from photos, circles and video chats, looking at less interesting, and perhaps even more actively-swirling area today, which is widely covered in the open spaces of the entire Internet - the IPO of Internet companies.This publication begins with a simple news: less than a day ago, one of the largest developers of social games, the company Zynga , submitted to the US Securities and Exchange Commission ( SEC ) a completed S-1 format on the initial listing of securities on the stock exchange, which is likely to be NASDAQ fully automated playground.

The document immediately puts the reader to himself, where CEO and company founder Mark Pincus addresses us on the pages: “At Zynga, we have a reverent attitude to the games that we do thanks to our relatives and friends. I love my stepbrother, who has five children and no free time, and he still plays Words with Friends. ”

')

Zynga’s entry into the stock market should not be described with the word “bubble” that excites many people, because This company is distinguished by high profitability, healthy profitability and relative economy in current operations. Although not everything is so smooth in the Danish kingdom, as it seems at first glance - so does Zynga’s business remain tightly dependent on another company that today doesn’t seem to go: Facebook.

But we will begin with the fundamentals, namely the financial indicators, which have now become known to all thanks to the S-1 form.

By placing securities on the stock exchange, Zynga hopes to raise from $ 1 to $ 2 billion of investor funds, with gross capitalization (so far - a little lower than the company's valuation in previous rounds of financing) of $ 15-20 billion.

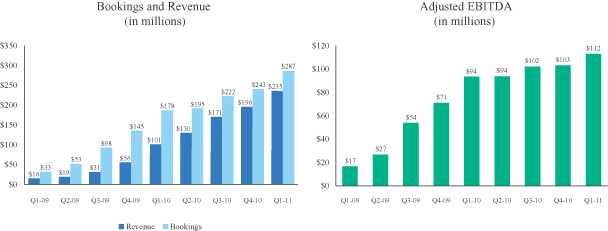

When looking down, the numbers look more than impressive: the company earned (revenue) about $ 600 million last year, earning a net profit of $ 90.6 million. Moreover, it should be noted separately the growth rates of key indicators: revenue grew by 392% in 2010, from $ 121.5 million in 2009 (even if the net loss in 2009 was not integer $ 54 million - in 2008 this amount was “only” $ 19 million ).

In the first quarter of this year alone, Zynga's net profit was $ 11.8 million, with revenue of $ 235.4 million. It is noteworthy that only a small part of these funds - only $ 13 million. Was received from promotional activities, everything else (95%) falls on in-game purchases. But the profitability of the advertising part of the gaming company's business grew quite well over the last quarter - by 321%, which indicates an already obvious fact - the company does not hope for one way of making profit by working through other channels of receiving funds. One can only rejoice at the current investors in such a rapidly growing business, managed by truly effective managers.

And finally, we all know that the largest players in the technology market like to save money in bins for possible future takeovers and mergers, as well as to keep current operations at a decent level: Apple, Google, MS, Oracle - all these giants have in their accounts huge amounts. Apparently, Zynga focuses on such a high level of the game, because already now more than $ 995 million of cash has been accumulated on its accounts. Basically, these funds were received from the sale of the company's securities in several rounds of investment.

Mark Pincus, according to information from the field, canceled his scheduled appearance at the popular D9 conference in California (ending in early June) in order to concentrate on the company's internal preparation for an IPO. In the three weeks that have passed since the first organizational meeting in Zynga, he and his team managed to prepare a 150-page document, which is an integral part of the application to the securities commission (along with the accounting reports from the auditor) and describes all the main advantages and disadvantages , companies for potential investors. Some have already managed to christen the company "speed-shooting" for a fantastic speed in the preparation of such a voluminous material.

Mark Pincus, according to information from the field, canceled his scheduled appearance at the popular D9 conference in California (ending in early June) in order to concentrate on the company's internal preparation for an IPO. In the three weeks that have passed since the first organizational meeting in Zynga, he and his team managed to prepare a 150-page document, which is an integral part of the application to the securities commission (along with the accounting reports from the auditor) and describes all the main advantages and disadvantages , companies for potential investors. Some have already managed to christen the company "speed-shooting" for a fantastic speed in the preparation of such a voluminous material.Here you must have asked the question: “What is the rush for?” Contrary to the first thought that occurred to the average man, it is unlikely due to the general hysteria in the IPO market. The reasons for which Zynga so urgently and at a fast pace filled all the papers most likely lies elsewhere.

The first, possible, reason is the loud appearance of everyone in sight, while the market is still in full swing with demand for shares of such companies (as recent and successful listings on the American NYSE and NASDAQ prove). After all, these forms are now filled with all the largest players in the market, trying to have time to jump into the drains before Facebook does it , pulling all the money out of the pockets of investors. Zynga’s financial performance is much cleaner than many competitors in the market, such as Groupon , and therefore sensible investors will not seriously consider promises , paying more and more attention to numbers - that is, the technical analysis of stocks of companies. But it all makes sense, I repeat, exactly until the moment when Facebook enters the market, and before that Zynga will be one of the most prominent players out there.

The company definitely understands this, since their business in general is very much dependent on today's most popular social platform, and they (Zynga) want to play in a big way, effectively “processing” market demand.

The second reason is that if Facebook enters the market and everything happens exactly as Mark Zuckerberg and all investors behind him thinks, Zynga herself will receive a huge karma bonus (abstractly) from increasing his own P / E ratio ( price / earnings: price / profit - specifically) as the largest player in the social games market, the cost of its shares will also increase (again, the flip side of this medal is that if Facebook’s securities fly into the price gap because of over-high ratings - they will pull over themselves and Zyng shares a) as a result of the banal "wow effect".

Although any player on the stock exchange understands that all the shares of technology companies will benefit from the successful entry of Facebook into the open market - you must already be a public company in order to benefit from it. And again - this is definitely known in Zynga.

Assistants in the implementation of IPO (underwriters) of the company are respected banks on Wall Street, such as: Morgan Stanley, Goldman Sachs, with additional assistance from Bank of America, Barclays Capital, JP Morgan and the little-known Allen and Company. From my own experience, I can say the following: with such a number of underwriters, the company most likely relies on serious investments, primarily from institutional companies (mainly funds), and only in second or third place is private capital as a means of attracting cash.

By their own rules

Following Groupon, who invented his own economic indicator, used in evaluating the success of a company, Zynga also made up its own so-called. Non-GAAP (Generally Accepted Accounting Principles - which means non-traditional market accounting principle of economic efficiency) indicator, called “Bookings”. Do not be confused by the name - it has nothing to do with reservations, and I personally would call it as follows: “this is what our company looks like if our main market was not Facebook”. However, jokes aside.

As usually happens, such an indicator makes the company more effective and successful, against generally accepted valuation principles. So, the total mass of Bookings for 2010 is $ 838.9 million, which is 40% more profit for the same period.

And this is how Zynga explains “Bookings”:

"Bookings (sorry for my French) is not a generally accepted measure of financial evaluation, which we describe as the total mass of income from the sale of in-game goods, as well as advertising, in the event that this profit would be described instantly at the time of the purchase-sale act (slightly below I will explain what the salt of this is “instantly”). We record the sale of a virtual product as income, describing its average life expectancy or how this product is used. ”

Don't be fooled by complex language - accounting magic is almost never simple. However, what Zynga’s finance department is trying to explain to us is a simple fact - today, 30% of the revenue earned on the Facebook platform goes to the latter because of the obligation to use Facebook Credits as the main in-game currency.

Ownership structure

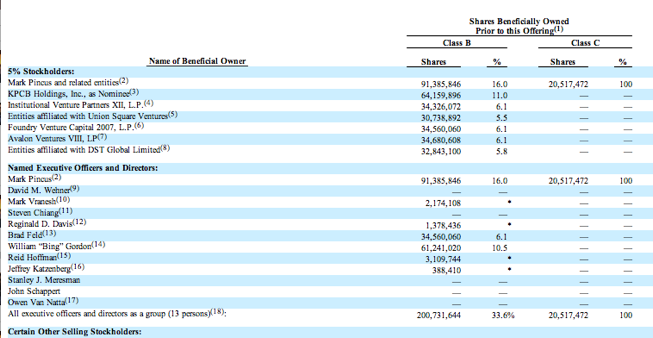

What Zynga really boasts is highly professional, experienced and well-known investors. The current investments were made by the following individuals, funds and companies: Reid Hoffman, DST, Google (by the word is the only company, not financial education - the volume of investments is from $ 100 to $ 200 million), Tiger Global, Kevin Rose, Kleiner Perkins, Union Square Ventures, Andreessen Horowitz, Peter Thiel, IVP, Foundry Group. I am sure that you know most of these names and they do not need additional submissions.

Pinzas (CEO and co-founder) remains the largest shareholder of the company, holding a 16% stake in Zynga (all of them in class B voting shares). The next in terms of pieces: Kleiner Perkins - 11%, IVP - 6.1%, Union Square Ventures - 5.5%, Foundry - 6.1%, Avalon Ventures - 6.1%, DST (hello to ours!) - 5.8%.

As for wages, everything is predictable - two top managers of the company: Mark Pincus and Van Natta receive a salary of $ 300,000 and $ 200,000, respectively. I am sure that no one offends the developers either.

Lecture hall

According to S-1 form, Zynga has more than 60 million active users in 138 countries around the world. 38,000 virtual things are created every second (in all games in total, of course), and in total, players spend about 2 billion minutes every day. The average player spends more than half an hour playing games, although for the company itself the so-called power-gamers who spend several hours per game every day. They also generate most of the company's revenue. The Pareto principle here is the legislator of statistics and profits.

According to S-1 form, Zynga has more than 60 million active users in 138 countries around the world. 38,000 virtual things are created every second (in all games in total, of course), and in total, players spend about 2 billion minutes every day. The average player spends more than half an hour playing games, although for the company itself the so-called power-gamers who spend several hours per game every day. They also generate most of the company's revenue. The Pareto principle here is the legislator of statistics and profits.The company does not hide this fact, and openly writes: “A small percentage of our players create almost the entire profit of the company. We lose paying players in the course of our business and therefore must attract new paying players or increase the amount of money our users pay, ”says the document. In other words, even with the current audience size, financial indicators will decline until the base of active buyers or the “average bill” changes.

“Historically, we were dependent on a small number of games that brought most of our profits, and we think that this dependence will continue in the near future,” the company says. “Our growth is tied to our ability to periodically launch new game projects and achieve significant popularity. Each of our games requires a lot of development time, marketing actions and other resources in order to run it and maintain it with regular upgrades and extensions, and the cost of such actions, on average, increases. "

Daily active audience: 62 million users

Monthly active audience: 236 million users

Monthly Unique Users: 146 Million

The difference between active and unique users is that the first are counted for each game individually, while a unique user may have more than one game "in the asset". In other words, at the time of filling in the exchange questionnaire, approximately 146 million people played one or several games of the company. That is, Zynga earns about $ 1.6 per user per quarter.

Facebook's best friend

Not without frankness - in a large document they reveal some details of how in 4 years they managed to build such a successful company, whose growth still shows a fantastic factor: “Facebook is the main distribution, marketing, advertising and payment channel for all our games. We generate almost all of our profits and attract players through the Facebook platform and we expect to continue this policy in the visible future. Any deterioration of our relationship with Facebook will harm the entire business and, accordingly, will affect the value of class A shares. ”

Zynga management literally warns investors: the company is in excellent shape when it comes to profit and growth, but it sits tightly on a volatile hook (that is, rapidly changing in price) and quickly moving from one hands to another property. Nothing about the future can be guaranteed.

Zynga relies on all channels of the social network: viral channels, tape type and notifications - to grow the audience of games; Facebook Credits for monetization - since Facebook obliged all developers to use their own loans for in-game purchases. And Zynga, from this point of view, is not in the best position - Facebook can at any time change the conditions, for example, the license agreement. Or, at any time, a little tweak the way that users interact with the application. Zynga will be forced to adapt in order not to suffer. And so - at least until 2015, when the current agreement of two, forgive, recent startups ends.

What is quite surprising about profits and connections with Facebook is that since July 2010, the company has been sharing its income with the social network, giving it 30% and without even losing momentum. The proportional growth of income fell from 30% to 15% in the fourth quarter of 2010, but then again pulled up to 20%, for the last financial period of 3 months.

On the pages of S-1 Zynga pen contains a very interesting description of the company, employing more than 2,000 employees and distinguished by rapid growth. But there it is also often mentioned how dangerous a business situation can be if it relies on a huge third-party platform, whose business is unlikely to deteriorate without you - and yours will go to hell without it.

Another tricky point is that Zynga works on modified terms of use in comparison with the agreement that is provided to ordinary developers. "In 2010, we agreed with Facebook on additions that changed the standard agreement for game developers, giving us control over the advertising, distribution and operations that take place within our games on Facebook."

Further details, of course, are not reported. I think for several reasons, one of which is a commercial secret, and the second is that Facebook in no way wants to lose such an active channel of receiving profit: according to statistical information, Zynga has more audience than 16 other popular developers social games combined.

This chapter ends with a trite word: the word Facebook is found 204 times in a completed summary.

Buy or not?

However, one can definitely say about Zynga - not everything concerns games there. For 4 years, a small studio has grown to 2,000 employees and 60 million active daily audience, with one billion dollars in the account. Serious difference from other hot technological IPOs that are ready to explode, or blown off, on the very first day of trading.

Plus - she makes money.

But for those who think that having an intimate connection with Facebook will have a bad effect on the future activities of the entire company, I will write the following - go check the Google + feed. Rumor has it, there are already blanks of social games in the code.

via ArsTechnica , TechCrunch , WallStreetJournal , Wired , SEC Archive

Source: https://habr.com/ru/post/123260/

All Articles