How a bitcoin network will be destroyed (practical tips with examples)

Many already know about the cryptocurrency - bitcoin , about its main features and typical misconceptions . Someone topics on this topic seem annoying and boring, I will try to deceive the expectations of the latter.

One of the main and most interesting features of the bitcoin network is its protection from 'hacking' and, to some extent, 'DoS attacks'. It’s impossible to charge coins for free (their speed is strictly controlled by difficulty based on the speed of finding the last blocks), the worst thing that the owner of more than half of the network’s power can do is cancel their transactions, and full control over the distribution medium (Internet) slows down the flow of transactions and if you physically divide the network into unrelated subnets, rollback of all transactions in all these separate subnets after the last merge except for one, the largest (separate and complicated conversation, which transactions will be r folded, and this is unprincipled).

There is also some danger of an attack on the network through an attack on the main developers in the real world (I don’t think that access to github servers and logs is a big problem) and the subsequent substitution of source codes synchronously with additional trojans aimed at finding and replacing already installed clients, but this more attack aimed at de-anonymization of new users, and, possibly, theft of funds. Such a substitution will give a temporary profit, but in the long term, the patches will be revealed by the community, and the developers will be replaced with new ones ...

')

In general, everything is not so scary and not fatal, I think such bitcoin network attacks are still waiting in the future, mainly through vulnerabilities in servers of mining pools or attacks to a temporary failure of the irc network and central nodes , which ensures the normal operation of the distributed mesh network (in their absence, there will be a noticeable decrease in the speed of data distribution over the network and even a temporary subnetting).

But the most interesting attack awaits almost the main protective function of the network - the calculation of complexity.

The speed of generating new blocks is governed by calculating the difficulty parameter, on the basis of which the limits on enumerating the values of each subsequent block are determined, but for some reason not clear to me, the complexity changes in leaps and bounds every 2016 blocks (as well as possibly looking for proofs and wanting to dig into In the code, the difficulty of reducing the difficulty is limited, in contrast to its increase, 'heard the ringing' on the irc channels freenet # .. bitcoin ..).

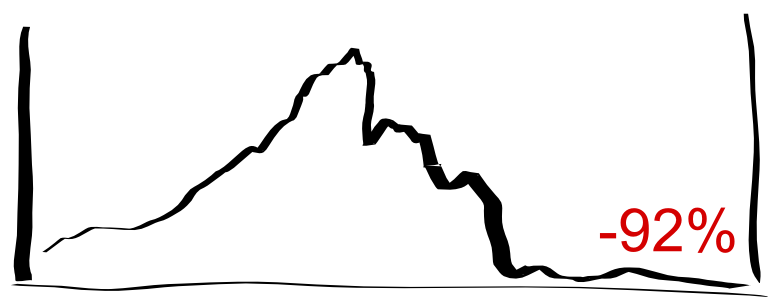

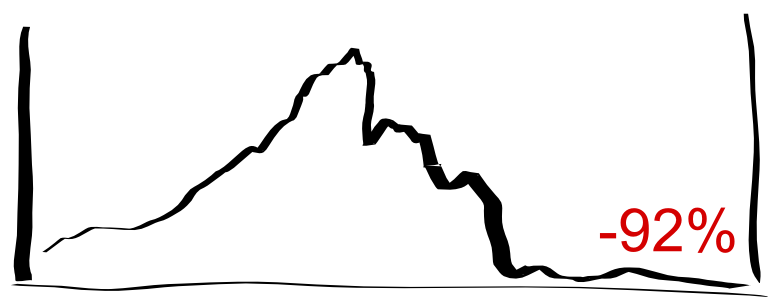

It is the need to recruit 2016 blocks until the recalculation of complexity can play a cruel joke, and this can be seen in the example of the network clone namecoin, when after the Namecoin topic . How to increase the income by 1.5 times the crowd of miners temporarily transferred their capacity to this network, raised its complexity and left as soon as complexity increased 4-5 times and the price of namecoin / bitcoin on the relevant stock exchange became unprofitable.

Now this network is experiencing a crisis - instead of 6 blocks per hour, the network hardly finds 15 in 13 hours , the next power is expected to be recalculated at best by August , but during this time its most ardent fans can leave the network. Mine namecoin cay is just expensive, not to mention the loss of profits. Imagine a situation where, after the next transition of miners between networks, complexity will jump tenfold and the time of the next shift may turn out to be years later.

"But this is a problem of the namecoin network, which exists in the shadow of its fellow bitcoin," you say, "this is her problem, the bitcoin network does not have a neighbor, from which power can temporarily come." Perhaps it is so, and it is very expensive, even briefly for weeks, to add power to the network several times (tens and hundreds) higher than the current, although how is it possible to use d-wave quantum computers or use a powerful optical processor? streaming miner on thousands of gigahashi - the same can be done only by very rich “clients” orstate corporations. But who else could be “like a bone in the throat” such a non-controlled network like bitcoin?

It is also possible to steer miners well, taking control over the bitcoin exchange rate for real currency, which would not be said, but this is now the main engine that allows the next miners to join the network. Even small and competent investments (especially now, after the attack on the main exchange mtgox, when volumes fell tenfold) money can gradually reduce the cost of bitcoin below their cost (now, taking into account the current complexity and its growth, it is $ 10, more correctly on the cost of power, but so clearer. The calculation was carried out taking into account the depreciation of iron, the cost of electricity, the administration of this iron, the risks in withdrawing funds and the banal comfort of miners - iron rustles and heats up a lot).

Imagine a course below $ 10 with a difficulty of 1.3kk will last a week! At first, the interested ones will fall off, then large nodes will be avalanched from mining, they have too much mining every day, the average power miners will be the longest, but their minority will remain. In addition, keeping a low rate may not be so expensive, at least comparable to current amounts of money in all the few bitcoin exchange markets.

One of the main and most interesting features of the bitcoin network is its protection from 'hacking' and, to some extent, 'DoS attacks'. It’s impossible to charge coins for free (their speed is strictly controlled by difficulty based on the speed of finding the last blocks), the worst thing that the owner of more than half of the network’s power can do is cancel their transactions, and full control over the distribution medium (Internet) slows down the flow of transactions and if you physically divide the network into unrelated subnets, rollback of all transactions in all these separate subnets after the last merge except for one, the largest (separate and complicated conversation, which transactions will be r folded, and this is unprincipled).

There is also some danger of an attack on the network through an attack on the main developers in the real world (I don’t think that access to github servers and logs is a big problem) and the subsequent substitution of source codes synchronously with additional trojans aimed at finding and replacing already installed clients, but this more attack aimed at de-anonymization of new users, and, possibly, theft of funds. Such a substitution will give a temporary profit, but in the long term, the patches will be revealed by the community, and the developers will be replaced with new ones ...

')

In general, everything is not so scary and not fatal, I think such bitcoin network attacks are still waiting in the future, mainly through vulnerabilities in servers of mining pools or attacks to a temporary failure of the irc network and central nodes , which ensures the normal operation of the distributed mesh network (in their absence, there will be a noticeable decrease in the speed of data distribution over the network and even a temporary subnetting).

But the most interesting attack awaits almost the main protective function of the network - the calculation of complexity.

The speed of generating new blocks is governed by calculating the difficulty parameter, on the basis of which the limits on enumerating the values of each subsequent block are determined, but for some reason not clear to me, the complexity changes in leaps and bounds every 2016 blocks (as well as possibly looking for proofs and wanting to dig into In the code, the difficulty of reducing the difficulty is limited, in contrast to its increase, 'heard the ringing' on the irc channels freenet # .. bitcoin ..).

It is the need to recruit 2016 blocks until the recalculation of complexity can play a cruel joke, and this can be seen in the example of the network clone namecoin, when after the Namecoin topic . How to increase the income by 1.5 times the crowd of miners temporarily transferred their capacity to this network, raised its complexity and left as soon as complexity increased 4-5 times and the price of namecoin / bitcoin on the relevant stock exchange became unprofitable.

Now this network is experiencing a crisis - instead of 6 blocks per hour, the network hardly finds 15 in 13 hours , the next power is expected to be recalculated at best by August , but during this time its most ardent fans can leave the network. Mine namecoin cay is just expensive, not to mention the loss of profits. Imagine a situation where, after the next transition of miners between networks, complexity will jump tenfold and the time of the next shift may turn out to be years later.

"But this is a problem of the namecoin network, which exists in the shadow of its fellow bitcoin," you say, "this is her problem, the bitcoin network does not have a neighbor, from which power can temporarily come." Perhaps it is so, and it is very expensive, even briefly for weeks, to add power to the network several times (tens and hundreds) higher than the current, although how is it possible to use d-wave quantum computers or use a powerful optical processor? streaming miner on thousands of gigahashi - the same can be done only by very rich “clients” or

It is also possible to steer miners well, taking control over the bitcoin exchange rate for real currency, which would not be said, but this is now the main engine that allows the next miners to join the network. Even small and competent investments (especially now, after the attack on the main exchange mtgox, when volumes fell tenfold) money can gradually reduce the cost of bitcoin below their cost (now, taking into account the current complexity and its growth, it is $ 10, more correctly on the cost of power, but so clearer. The calculation was carried out taking into account the depreciation of iron, the cost of electricity, the administration of this iron, the risks in withdrawing funds and the banal comfort of miners - iron rustles and heats up a lot).

Imagine a course below $ 10 with a difficulty of 1.3kk will last a week! At first, the interested ones will fall off, then large nodes will be avalanched from mining, they have too much mining every day, the average power miners will be the longest, but their minority will remain. In addition, keeping a low rate may not be so expensive, at least comparable to current amounts of money in all the few bitcoin exchange markets.

Source: https://habr.com/ru/post/122935/

All Articles