How to buy shares of IT-companies on foreign exchanges? (part 1)

Many of you, reading articles about successful IT firms and rapidly developing high-tech companies in Habré, probably thought about investing your money in their stocks for profit when, in a few months or even years, the market value of these stocks noticeably grows. .

Many of you, reading articles about successful IT firms and rapidly developing high-tech companies in Habré, probably thought about investing your money in their stocks for profit when, in a few months or even years, the market value of these stocks noticeably grows. .I myself often thought about it myself, but every time I was stopped by a complete lack of experience in matters of stock trading (I had never traded securities even on Russian stock exchanges before) and practically zero knowledge of the theory of stock trading.

It is because of this fear of the unknown, and also because of one’s own laziness (unwillingness to understand a new area from scratch) that many still don’t dare to buy stocks, although they have enough start-up capital to enter this market.

But in the end, I still made an effort on myself: at first I delved into the basics of stock trading, and then finally decided and began to trade stocks on US stock markets (NYSE, NASDAQ, AMEX). And, most importantly, I realized that buying shares was not so difficult as it seemed before, and not even as expensive (in terms of overhead), as I had assumed. And in this article I want to share only my experience in this field in the form of general theoretical information and practical guidance (HOWTO) for beginners.

')

You will not find here descriptions of methods and strategies for trading in stock markets, and you certainly will not become a professional stock trader immediately after reading this article. The article is simply about how a novice without the experience of stock trading to buy shares on foreign exchanges.

The Russian realities are described here in the first place, but the article may also be useful in many respects for the citizens of some neighboring countries. If you have certain financial savings and want to invest in shares of foreign companies, but do not yet know how to do it, what you need to do and where to start, then this article is for you.

Divided the article into two parts:

- In the first part, we consider the theoretical foundations of stock trading.

- In the second part there will be a practical guide for newbies on buying and selling stocks.

Some introductory facts and definitions

- Stock exchanges are securities markets. There are many stock exchanges in the world in various countries: New York Stock Exchange (NYSE), NASDAQ , American Stock Exchange (AMEX), Toronto Stock Exchange (TSX), London Stock Exchange (LSE), Euronext Paris , Berlin Stock Exchange ( Berliner Börse ), Frankfurt Stock Exchange , Tokyo Stock Exchange , Shanghai Stock Exchange , Hong Kong Stock Exchange (HKEX), Taiwan Stock Exchange, Korea Exchange (KRX), Bombay Stock Exchange , Australian Securities Exchange (ASX), RTS Stock Exchange , etc. This article will discuss the trading of securities on the example of US stock exchanges: ( NYSE and NASDAQ ).

- Each stock exchange trades securities in the currency of the country in which the exchange is located. On US exchanges (NASDAQ, NYSE, AMEX) - in US dollars (USD), on the London Stock Exchange - in British pounds (GBP), on the stock exchanges of France, Germany, Spain - in euros (EUR), on the Tokyo Stock Exchange - in Japanese yen (JPY), etc.

- The stock exchanges trade in various securities: stocks , bonds , options , futures , bills , depositary receipts . In this article we will consider only the purchase and sale of shares of various companies.

A ticker (ticker, ticker symbol , also stock symbol, sometimes just a symbol) is a short alphanumeric designation (code) of a company's shares on a particular exchange. On American and European exchanges, it is customary to use letter tickers, which are usually abbreviations on behalf of the company itself (for example, GOOG - Google Inc., MSFT - Microsoft Corporation, DSY - Dassault Systèmes). On Asian markets, stocks are usually given numeric tickers (for example, 0992 - Lenovo Group Limited, 2498 - HTC Corporation, 2357 - ASUSTEK Computer, 6758 - Sony Corporation, 6752 - Panasonic Corporation).

A ticker (ticker, ticker symbol , also stock symbol, sometimes just a symbol) is a short alphanumeric designation (code) of a company's shares on a particular exchange. On American and European exchanges, it is customary to use letter tickers, which are usually abbreviations on behalf of the company itself (for example, GOOG - Google Inc., MSFT - Microsoft Corporation, DSY - Dassault Systèmes). On Asian markets, stocks are usually given numeric tickers (for example, 0992 - Lenovo Group Limited, 2498 - HTC Corporation, 2357 - ASUSTEK Computer, 6758 - Sony Corporation, 6752 - Panasonic Corporation).

The ticker is unique only within one exchange. If a company exposes its shares on different exchanges, then on one exchange its shares may have one ticker, and on another exchange - another ticker. To uniquely identify specific stocks, you need to know the name of the exchange, and the ticker of the shares on this exchange. Therefore, specific shares are often denoted by the abbreviated name of the exchange + through the colon ticker of specific shares, for example, HKG: 0992, TYO: 6758, NASDAQ: MSFT, NYSE: RHT, EPA: DSY, TPE: 2498.- In addition to the tickers for the designation of securities using ISIN ( International Securities Identification Number ) - is the international identification code of the security, which is unique in all global exchanges.

The structure of the ISIN is described in ISO 6166 . The first two ISIN characters are the two-letter country code of the issuer of the security, for example, US - USA, CA - Canada, RU - Russia (for a full list of country codes, see ISO 3166-1 ). This is followed by 9 letters and numbers of the national security identification code (National Securities Identification Number, NSIN ). The code completes the check digit .

The ISIN code is assigned by national numbering agencies ( NNA ). - Some companies place their shares only on one of the world exchanges, while others are presented simultaneously on several world exchanges in different regions (America, Europe, Asia).

The US NASDAQ Stock Exchange specializes in shares of high-tech companies (electronics, software, etc.), first of all there are American companies from Silicon Valley. But there is no hard division according to the types of companies represented between exchanges; shares of leading IT companies can be found not only on the NASDAQ exchange.

For example, here are a few companies that trade on the NASDAQ : Google ( GOOG ), Microsoft ( MSFT ), Apple ( AAPL ), Cisco Systems ( CSCO ), Yahoo! ( YHOO ), Baidu.com ( BIDU ), Amazon.com ( AMZN ), Adobe Systems ( ADBE ), Autodesk ( ADSK ), ANSYS ( ANSS ), Oracle ( ORCL ), Dell ( DELL ), Intell ( INTC ), nVidia ( NVDA ), Broadcom ( BRCM ), Citrix ( CTXS ), Symantec ( SYMC ), Tesla Motors ( TSLA ), etc. (see full list ).

And here are a few companies that are traded on the New York Stock Exchange (NYSE) : Red Hat ( RHT ), Hewlett-Packard ( HPQ ), AMD ( AMD ), IBM ( IBM ), Hitachi ( HIT ), EMC ( EMC ) , VMware ( VMW ), Juniper ( JNPR ), Motorola ( MMI ), AT & T ( T ), Verizon ( VZ ), AOL ( AOL ), LinkedIn Corp ( LNKD ), Toyota Motor ( TM ), General Motors ( GM ), Ford ( F ), Honda Motor ( HMC ), General Electric ( GE ) and others (see full list ).

There are also companies from the electronics, computer, telecommunications and software sectors on the American AMEX , but there are very few of them and they are mostly unknown in the world (see the full list ). - Issue - a procedure established by law for issuing shares of a company. Issuer - an organization (company) that has issued (issued) securities for the development and financing of its activities.

- IPO ( Initial public offering ) - the initial public offering of the company's shares for sale to a wide range of persons. This implies that the issuing company for the first time brings its shares to the stock exchange, offering them to an unlimited circle of persons. After entering an IPO, a startup or private company officially becomes a public company. Before taking the company's shares to the exchange, the company is audited, its assets are valued and its shares are calculated.

An IPO (i.e., putting companies into free sale on the stock exchange) is beneficial to various parties. For company owners, this allows them to attract additional investments from a wide range of investors. Investors, on the other hand, can buy shares in a company in the event of the company's future financial success and, accordingly, an increase in the market value of the shares.

The experience of entering the IPO of IT companies in recent years shows that the value of shares is noticeably reduced after 1-3 weeks after the start of trading on the exchange. Therefore, if you decide to buy shares of some IT-company immediately after the IPO, it is better to bear at least a week. - Listing (from the English list - list) - a set of procedures for the inclusion of securities in the exchange list (list of securities admitted to exchange trading), monitoring the compliance of securities with the conditions and requirements established by the exchange. During the listing, the stock exchange conducts an examination of the securities and verifies the legality of the financial and economic activities of the issuing company. All securities issued by the issuing company to the exchange are subject to listing.

Delisting is the reverse procedure, i.e. exclusion of the company's shares from the list of traded on a particular stock exchange. - Players in the securities market can be divided into two categories: traders and investors.

Investors buy and sell stocks relatively rarely, i.e. make long-term (for several months or even years) investing in shares of one or several companies. Moreover, stock investors use for the purchase of shares only their own funds.

Investors buy and sell stocks relatively rarely, i.e. make long-term (for several months or even years) investing in shares of one or several companies. Moreover, stock investors use for the purchase of shares only their own funds. Traders are more active in trading stocks, often buying and often selling stocks of various companies. Moreover, exchange traders often trade not only with their own funds, but also use borrowed funds for the purchase of shares (for more details, see margin trading - trading with leverage).

Traders are more active in trading stocks, often buying and often selling stocks of various companies. Moreover, exchange traders often trade not only with their own funds, but also use borrowed funds for the purchase of shares (for more details, see margin trading - trading with leverage).

Traders , in turn, are also divided into different categories according to various criteria. For example, by the duration of transactions (ie, the time from purchase to sale of shares):

Day trader (day trader) - makes deals within one trading day (one trading session), closes all positions before closing the exchange day without transferring trades to the next day. The duration of transactions at day traders from tens of minutes to several hours.

A scalper (he is a pipsman, he is a hare) - an even more short-term trader, makes a large number of transactions with a duration from several seconds to several minutes. On each transaction, earns a little (because the value of shares in this interval varies slightly), but at the expense of the huge number of such short-term transactions during one trading session can be pretty decent amount. In the field of scalping (pipsing) in recent years, exchange robots (automated trading systems) have been very successful. With the help of the algorithms embedded in them, these robots automatically analyze micro oscillations and trends in the course of various stocks and automatically put in orders for their purchase and sale.

In the field of scalping (pipsing) in recent years, exchange robots (automated trading systems) have been very successful. With the help of the algorithms embedded in them, these robots automatically analyze micro oscillations and trends in the course of various stocks and automatically put in orders for their purchase and sale.

They are able to put a huge number of applications per unit of time. A live trader can no longer keep up with them in the speed of data analysis and bidding. Therefore, in the area of scalping on the stock exchanges, there are practically no chances for people against modern stock trading robots. As a robot Bender would say: “Kiss my shiny metal ass, pathetic pieces of meat!” . Glory to the robots!

Sometimes investors are considered as a kind of traders, but in my classification I decided to separate them.

If an individual (individual) acts as an investor, then he is usually called a private investor. This article will discuss how to become a private investor. However, having tried yourself in the role of an investor, you later may want to engage in more active trading in stocks and move into the category of exchange traders. - It is not the investor himself who is engaged in buying and selling stocks directly on the stock exchanges, but a special intermediary, called a broker. A broker is a sales representative who is a professional market participant and makes transactions on the stock exchange on behalf of a client (investor) and at his expense.

Brokerage services in global markets for the end client are usually provided by numerous investment / brokerage companies. - The general scheme of stock trading on the stock exchange, briefly, looks like this:

a. The client (investor) opens a brokerage (trading) account in a brokerage company and transfers funds from his bank account to it.

b. When a client wants to buy some shares, he submits to the broker the order to purchase shares. In this case, the client’s brokerage account is debited for the purchase of shares, as well as other fees and commissions.

c. When a client wants to sell existing shares, he submits to the broker the order to sell the shares. In this case, the funds received from the sale arrive at the brokerage account minus fees and commissions.

d. The client can withdraw money from the brokerage account to his bank account or, on the contrary, add additional funds from the bank account to the brokerage account.

But in order to understand which investment company will suit you and which one will not, I will set forth some more important theoretical information about investment companies.

What you need to know before looking for an investment / brokerage company in Russia

Firstly, it should be understood that not all Russian investment / brokerage companies trade in Western stock markets. Many of them trade (and, accordingly, provide brokerage services) only on Russian stock exchanges (RTS, MICEX, SPCE, etc.).

Secondly, some of those Russian investment companies that still trade in Western markets provide brokerage services on these exchanges only for legal entities, and they do not work with private investors.

And thirdly, some of those Russian investment companies that still provide brokerage services in Western securities markets to Russian individuals provide such services not to everyone, but only to qualified investors.

According to Russian legislation on the securities market for trading stocks on foreign stock exchanges, you must be a qualified investor .

A qualified investor is not just a name, it is an official status established by Russian legislation.

The term “qualified investor” was introduced by the Order of the Federal Service for Financial Markets (FSFM) of March 18, 2008 “08-12 / pz-n”. This order approved the Regulation on the procedure for recognizing persons as qualified investors, according to which individuals, for recognition as qualified investors, must meet certain requirements.

The term “qualified investor” was introduced by the Order of the Federal Service for Financial Markets (FSFM) of March 18, 2008 “08-12 / pz-n”. This order approved the Regulation on the procedure for recognizing persons as qualified investors, according to which individuals, for recognition as qualified investors, must meet certain requirements.An individual may be recognized as a qualified investor if he meets any two requirements listed below:As you can see, for a beginner in stock trading these are obviously impracticable requirements. Therefore, if you are only planning to buy shares, but have never done this before, then you will not be able to immediately receive the status of a qualified investor.

- Owns securities and (or) other financial instruments meeting the requirements of legislation, the total value of which is at least 3 million rubles.

In determining the total value of these securities and (or) other financial instruments, the corresponding financial instruments transferred by an individual into trust management are also taken into account.- She has experience in a Russian and (or) foreign organization that carried out transactions with securities and (or) other financial instruments:

- not less than 1 year, if such an organization (organizations) is a qualified investor by virtue of clause 2 of Article 51.2 of the Federal Law “On the Securities Market”;

or

- at least 3 months if such organization (organizations) is a qualified investor by virtue of paragraph 2 of Article 51.2 of the Federal Law “On the Securities Market” and on the date of recognition of a person as a qualified investor, this person is an employee of the specified organization;

- at least 2 years in other cases.- Performed quarterly at least 10 transactions with securities and (or) other financial instruments during the last 4 quarters, the total price of which for the 4 quarters was at least 300,000 rubles, or made at least 5 transactions with securities and (or ) other financial instruments over the past 3 years, the total price of which amounted to at least 3 million rubles.

However, there is a way around this limitation.

The fact is that it is necessary to meet the requirements of Russian legislation and have the official status of a qualified investor for trading on foreign exchanges only if you are trading from the territory of Russia, i.e. if your brokerage account is located on the territory of the Russian Federation.

And if the brokerage company and, accordingly, the brokerage account through which shares are bought / sold are located outside of Russia, then they no longer fall under the jurisdiction of Russian exchange legislation. And it is this scheme that will suit you if you are new to the stock exchange. Below I will describe in more detail this scheme of access to Western stock exchanges under the code name "Cyprus brokerage scheme."

Cyprus brokerage scheme

(At once I will make a reservation that the “Cyprus scheme” is an unofficial name, I used it in my article just for brevity)

The scheme is used for access of Russian investors to foreign stock exchanges and is as follows.

The scheme is used for access of Russian investors to foreign stock exchanges and is as follows.- A Russian investment company (or bank) registers its subsidiary brokerage company in the Republic of Cyprus.

- A Russian investor who wants to trade stocks on foreign stock exchanges is turning to this Russian investment company.

- There he is offered for trading on foreign stock exchanges to enter into a brokerage service contract directly with their subsidiary company in Cyprus.

- The client (investor) concludes this brokerage service agreement with a Cyprus brokerage company, opens his brokerage account with this company in Cyprus, transfers funds from his Russian bank account to it.

- Next, the investor buys and sells shares on foreign stock exchanges through this brokerage account.

- Income received after the sale of shares on a brokerage account can be transferred to a bank account in Russia.

The purpose of this scheme is precisely to deduce the client's exchange activities from the legal field of Russian legislation in order to circumvent a number of restrictions that are imposed by the laws of the Russian Federation.

Why precisely Cyprus?

Why do Russian banks and investment companies implement this scheme through a brokerage company in Cyprus? Why not in any other country outside of Russia?

Some people mistakenly believe that the choice of the country is due to the fact that Cyprus is an offshore zone. However, this is no longer the case. Offshore zone is the past of Cyprus. In 2004, the Republic of Cyprus joined the EU, and then the offshore regime for international companies ceased there. And in 2008 the Republic of Cyprus also joined the euro zone.

That is why in my description I called this scheme Cypriot, and not offshore.

However, in Cyprus, although it is more officially and not offshore, favorable tax conditions for brokerage companies still remain, and this is why:

- According to the tax laws of the Republic of Cyprus (Cyprus Law "On Income Tax" of 2002), income received in Cyprus from the sale of securities, as well as in the form of dividends, is fully exempt from taxes.

- For other types of income in Cyprus there is a single tax rate of 10% - this is the lowest income tax rate in the European Union.

- Since 1998, a bilateral agreement on the elimination of double taxation has been in force between Russia and the Republic of Cyprus.

We’ll talk about taxes later, but in the meantime just remember that the Cyprus brokerage scheme described is the only option for a beginning private investor from Russia to buy / sell shares of foreign companies in Western stock markets .

Depositing funds to a brokerage account

So, let's say you found a Russian investment / brokerage company that gives private investors access to the US stock markets (NYSE, NASDAQ) using the “Cyprus scheme”. You sign a contract with their Cypriot subsidiary, open a brokerage account in their Cyprus office. Now you need to transfer money to this brokerage account.

So, let's say you found a Russian investment / brokerage company that gives private investors access to the US stock markets (NYSE, NASDAQ) using the “Cyprus scheme”. You sign a contract with their Cypriot subsidiary, open a brokerage account in their Cyprus office. Now you need to transfer money to this brokerage account.Depositing funds to a brokerage account opened with a Cyprus brokerage company is possible only with a bank transfer from any bank account. You can not deposit funds to a brokerage account in cash through the cashier.

When signing a contract for brokerage services and opening a brokerage account in Cyprus, you will be given the details of this account. And further on these details you can make an interbank transfer of funds from your account from any Russian bank.

Brokerage companies do not charge clients for depositing funds into a brokerage account. However, the majority of Russian banks charge their clients for inter-bank transfer fees from their bank accounts to accounts with other banks. How much this commission will make depends solely on the tariffs of your bank.

What to do if you still do not have your account in a Russian bank?

It's not a problem. All (or almost all) Russian investment companies that provide brokerage services on foreign exchanges have their own Russian subsidiary bank. When signing a contract for brokerage services, you can immediately ask to open for you a bank account in their Russian bank.

It's not a problem. All (or almost all) Russian investment companies that provide brokerage services on foreign exchanges have their own Russian subsidiary bank. When signing a contract for brokerage services, you can immediately ask to open for you a bank account in their Russian bank.Opening and maintaining this Russian bank account is usually free. The commission for an interbank transfer from this Russian account to your brokerage account opened in Cyprus is usually also not charged (since these are usually related banks owned by one holding company and the relevant agreement has been concluded between them).

Many Russian private investors, who already even have accounts in other Russian banks, still do not refuse such an opportunity and, when signing a contract for brokerage services, at the same time open an additional bank account in a Russian bank of the chosen investment company. Through this account and carry out the input of funds to your brokerage account. The choice in favor of such a scheme for depositing funds may be for various reasons:

- in other Russian banks there are high interbank transfer fees;

- in other banks, the procedure of interbank transfer abroad for hemorrhoids (you need to additionally come to the department, wait in line and independently fill in some pieces of paper);

- other banks have a daily limit on the amount of the interbank transfer;

And then a bank account will be opened for free right in front of you and on the spot. Immediately after the signing of the contract you can make money in cash through the cashier. And right there you will be helped to transfer funds deposited from it to your brokerage account in Cyprus, they will fill in all the necessary papers for you (transfer order), you just need to sign it.

Many customers find this method more convenient for themselves than transferring money through another bank. Therefore, I recommend that you also consider this option if your chosen investment company provides such an opportunity.

For foreigners, this may seem like something wild when a person in one bank at an ATM or cashier withdraws a large amount of cash from his bank account, then carries them in his pocket / bag / backpack down the street to a branch of another bank and brings them there again. your own bank account through a cashier or an ATM with a cash-in. However, due to the greed of Russian banks, many customers still choose such an unsafe scheme with manual transfer of funds between bank accounts.

In which currencies can I deposit funds into a brokerage account?

If you trade on the US stock exchanges, then your brokerage account will, of course, be in US dollars (USD). However, this does not mean that you must first convert all your funds into USD and transfer them to a brokerage account already in dollars.

If you trade on the US stock exchanges, then your brokerage account will, of course, be in US dollars (USD). However, this does not mean that you must first convert all your funds into USD and transfer them to a brokerage account already in dollars.Russian investment companies usually allow you to transfer funds to your brokerage account in any of the four currencies: US dollars (USD), euro (EUR), pounds sterling (GBP) and Russian rubles (RUR). The scheme of such a transfer is as follows:

- When you open a brokerage account, you report in which currencies you plan to deposit funds (in one or in several).

- , . , .

- .

- , . , USD-, — ..

- .

- .

- , USD, .

Stock purchase

As mentioned above, the broker itself conducts transactions directly on the exchange. The investor makes a decision on the purchase or sale of shares and gives the broker an order (order, order) to complete the transaction.

There are several ways to submit orders (applications) for the exchange transaction:

- Independent formation of trade orders through the exchange terminal.

- Submission of instructions "from the voice."

- Submission of orders from the browser via the web interface.

Stock trading through stock terminals

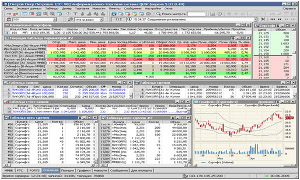

If the exchange terminal is used on a computer, the corresponding client application is downloaded and installed to complete transactions via the trading system supported by the selected broker (for example, QUIK, Laser Trade, ROX Integral, MetaTrader, etc.). To set up secure (encrypted) data exchange with the broker's server, the client generates a key pair, and then exchanges public keys with the broker by email. After setting up the software, the client (investor / trader) can independently perform the full range of exchange operations through the interface of the installed application: track the quotes of the stocks of interest, view current buy / sell orders, give trade orders (buy / sell orders), track their status and etc.

If the exchange terminal is used on a computer, the corresponding client application is downloaded and installed to complete transactions via the trading system supported by the selected broker (for example, QUIK, Laser Trade, ROX Integral, MetaTrader, etc.). To set up secure (encrypted) data exchange with the broker's server, the client generates a key pair, and then exchanges public keys with the broker by email. After setting up the software, the client (investor / trader) can independently perform the full range of exchange operations through the interface of the installed application: track the quotes of the stocks of interest, view current buy / sell orders, give trade orders (buy / sell orders), track their status and etc.To date, all client applications for exchange trading systems are available only under Windows. Linux and Mac OS X users run them either in virtual machines or via WINE.

The interface of these applications is very complex and overloaded with a variety of information. These exchange terminals are focused primarily on trained traders who are well-versed in this subject and actively trade on exchanges constantly. An inexperienced newcomer who is not well versed in trading terminology and in many aspects of stock trading will not be easy to understand and master this interface.

If you are planning an investment strategy on the stock exchange (that is, occasionally making one-time deals for buying / selling shares), then I would not advise you to bother with mastering these applications. Moreover, most of their functionality will not be in demand for you in this case.

For access to this trading terminal a monthly fee is charged from the client’s brokerage account monthly.

Trading shares "with voice"

In the case of the submission of voice orders (in the slang of brokers, this is called “instructions from the voice”), applications for the execution of a transaction are made by phone, simply by words. After signing a brokerage contract, the broker sends the generated list of voice passwords to the client. To receive orders by phone, the broker has a special multi-channel phone (or just a few phone numbers). In the case of an investment company represented in Moscow, there are usually both Moscow phone numbers and a number with the prefix 8-800 for free calls from all over Russia.

In the case of the submission of voice orders (in the slang of brokers, this is called “instructions from the voice”), applications for the execution of a transaction are made by phone, simply by words. After signing a brokerage contract, the broker sends the generated list of voice passwords to the client. To receive orders by phone, the broker has a special multi-channel phone (or just a few phone numbers). In the case of an investment company represented in Moscow, there are usually both Moscow phone numbers and a number with the prefix 8-800 for free calls from all over Russia.When a client (investor / trader) wants to make a deal to buy or sell shares, he calls this number, it appears, calls the number of the brokerage contract and passes voice authentication using the existing list of voice passwords. Then he announces to the broker what he wants to do (buy / sell), with which stocks and how many. The broker listens to the order, clogs it in the trading terminal, voices it, names the current value of the specified shares and asks to confirm the completion of the transaction. After confirmation, he conducts the transaction (orders at the market price are executed immediately, orders with the specified price are put in a queue; the types of orders below are discussed in more detail) and reports the final amount of the transaction at the time of its execution.

If you sell / buy shares of some well-known well-known companies, it is enough for a broker to simply name the company. And if you make a deal with the shares of a little-known or hard-to-pronounce company, then it is better for the broker to indicate the name of the exchange and the ticker of the shares, well, or their ISIN.

The entire customer conversation with the broker is recorded in case of controversial situations like: “Oh, what have you done? I didn’t mean it at all! ”

Knowledge of foreign languages for voice orders is not required. In Russian investment companies operating according to the “Cyprus scheme”, all the brokers on the phones are Russian (at least Russian-speaking).

Submission of orders for exchange transactions through the telephone can be used as an independent (primary and only) way of working with a broker investor, as well as an auxiliary (alternate) option in case, for example, a computer with an installed trading application is unavailable or there are problems with access to the Internet.

For voice orders, authentication is usually based on a list of voice passwords. After the conclusion of a brokerage contract, an individual numbered list of 20-30 random numeric or alphanumeric sequences is generated and sent to the client. The operator (broker) to authenticate the client necessarily asks for the contract number (to select a list of passwords for authentication) and asks to dictate one (or two, if in doubt) of the password from this list, and the operator himself calls the numbers of the requested passwords (for each call asks for a password with any number from this list that he wants at the moment). For example: “Spell password number 17”.

The way to trade "from voice", although it is very antediluvian, with a time delay (while you communicate with a broker, the stock price may change noticeably) and not too secure (voice passwords can be overheard / stolen), but it’s the most understandable and easy to learn for beginners. And if you are not planning active trading, but long-term investment in stocks, i.e. if you make one-time transactions on the stock exchange (once a week, or rather even less often), I would recommend that you start with voice instructions.

Most brokers do not charge a fee for giving voice orders. But some have a fixed fee for each voice instruction.

Stock trading through the web interface

Some brokerage companies, in addition to stock exchange terminals and voice orders, also provide their clients with the opportunity to submit trade orders via a web interface. This is essentially close to the terminal application (because it is done by the client on a software basis online), but the functionality is much poorer and the interface is much simpler. However, for the investor (or not too active trader) the functional will still be more than enough.

Security of such web services is usually provided by HTTPS connections and login / password authentication. Access to the web application is usually free.

Brokerage Commission for the purchase of shares

Regardless of the method of submitting applications for the purchase of shares (terminal, telephone or otherwise), in addition to the amount of purchase of shares, you will also have to pay a brokerage commission. Brokers operating on the US stock exchanges (NASDAQ, NYSE, AMEX), it is customary to take a commission not as a percentage of the transaction amount, but as a fixed amount of money for each share purchased. On average, this is 1 cent (0.01 USD) for each share purchased. Sometimes it happens that for active traders, brokers reduce the commission to 0.9, 0.8 or 0.7 cents per share (and even lower), and for low-active investors who occasionally make one-off transactions, on the contrary, they can increase this commission to 1.1 or 1.2 cents per share. But on average in industry, the commission is exactly 1 cent per share, so be guided by this value.

Regardless of the method of submitting applications for the purchase of shares (terminal, telephone or otherwise), in addition to the amount of purchase of shares, you will also have to pay a brokerage commission. Brokers operating on the US stock exchanges (NASDAQ, NYSE, AMEX), it is customary to take a commission not as a percentage of the transaction amount, but as a fixed amount of money for each share purchased. On average, this is 1 cent (0.01 USD) for each share purchased. Sometimes it happens that for active traders, brokers reduce the commission to 0.9, 0.8 or 0.7 cents per share (and even lower), and for low-active investors who occasionally make one-off transactions, on the contrary, they can increase this commission to 1.1 or 1.2 cents per share. But on average in industry, the commission is exactly 1 cent per share, so be guided by this value.With a brokerage commission of 1 cent per share, if you buy 1,000 shares, in addition to their cost, you pay the broker a commission of $ 10. At the same time, it does not matter how much the shares themselves cost, maybe $ 20 per share, or maybe $ 600, only the amount will affect the size of the brokerage commission.

Sometimes brokerage fees also specify a minimum commission for a broker. Those.“broker commission: 1 cent per share, but not less than $ 10” may be indicated. In this case, when you buy 2,000 shares, you pay the broker a commission of $ 20, when you buy 1,500 shares - a commission of $ 15, and if you buy 1,000 or less shares, a commission of $ 10 (since this is the minimum commission). If some minimum brokerage commission is specified in the tariffs, then it is usually in the range of $ 5 to $ 15.

As a rule, the brokerage service agreement gives the client (investor) the opportunity to trade immediately on many foreign stock markets (all of them will be listed in the agreement). And the rates of the brokerage company may differ depending on the exchange on which you will trade stocks. But US stock markets (NASDAQ, NYSE, AMEX) in brokerage contracts always come in one package and all are serviced at uniform rates. Therefore, it does not matter which of these exchanges you will trade stocks in, the cost of services will be the same everywhere.

Types of transactions and types of orders (orders / orders) for the transaction

Stock trading happens at a long position [Long] (when stocks are bought with a future growth in their value, and after an increase in their value they are sold) and in a short position [Short] (when shares are borrowed from a broker with a future reduction in their value, these shares are sold at a high price, and after reducing their value, they are again bought at a low price and returned to the broker).

Accordingly, there are only three types of stock transactions with shares:

Accordingly, there are only three types of stock transactions with shares:- Buy - buy stock.

- Sell - sale of previously purchased shares.

- Sell Short - sale of shares borrowed from a broker.

Short positions and trading on credit in general is the lot of traders only. We will not dwell on this in detail. If we consider trading in stocks from the position of an investor, then it will always be trading in a long position.

Exchange orders (they are orders or orders) for a transaction are also of different types:

- Market Order ( ) — / . . , . .

- Limit Order ( ) — , / ( ) . . Those. (Buy Limit Order) , (Sell Limit Order) . , , , , , ( ).

- Stop Order («»-) — -, . , «»- . , , «»- . -, (Market Order), .. . - , .

- Stop Limit Order ("stop" - limit order) - in this application, the "stop" price and the limit price are simultaneously indicated. If someone else in the market makes a transaction with these shares at a price that reaches the “stop” price or passes it, then this application automatically turns into a Limit Order and is executed at a price equal to or better than the specified limit. .

Stop orders are usually used only by traders. From the investor’s position, it’s enough to know and use market orders (Market Order), well, and sometimes limited orders (Limit Order) - this is the case when you expect the stock price to improve during the day, but you don’t want to sit and wait for this price to submit a market order in online, then you place a limited order with a price slightly better than the current market one, so that it will automatically execute when that price is reached.

How many shares can I buy?

On some stock exchanges, certain stocks are traded not by the piece, but by lots. A lot is a fixed amount of securities (a package), less than which it is impossible to buy and sell concrete papers. Lot size is different for different stocks: for some stocks, the lot size can be 10, for the other 100, for the third 500 or other quantities (usually the cheaper the shares, the larger the lot size for them). Accordingly, the shares can be bought and sold only in a quantity that is a multiple of the lot size.

But this does not apply to the US stock exchanges (NASDAQ, NYSE, AMEX), all shares are traded on them individually. Those.on the NASDAQ, NYSE, AMEX exchanges you can buy and sell any number of shares: at least one, at least 50, at least 143, at least 1001. But you need to understand that buying / selling only one share will not be too profitable, in this case, fixed overhead costs for the purchase, sale and withdrawal of funds will already constitute a significant percentage of the total costs of the transaction.

And if you trade stocks on other (non-US) stock exchanges, you should first specify (for example, from a broker) the lot size for the stocks you are interested in.

The queue of applications for the transaction. "Glass" trading terminal

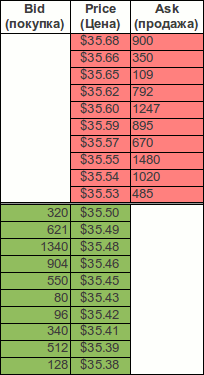

For a visual representation of the queue of current bids for the purchase and sale of shares of any company in the trading terminals usually use a table that is called “glass” in the trading slang (it is also “stock exchange glass”, “trading glass”, “application glass” or “ glass of the trading terminal "). In English terminology, “glass” may be called DOM (Depth Of Market), Market Depth, OpenBook, or Blotter. It usually looks like the one on the right.

For a visual representation of the queue of current bids for the purchase and sale of shares of any company in the trading terminals usually use a table that is called “glass” in the trading slang (it is also “stock exchange glass”, “trading glass”, “application glass” or “ glass of the trading terminal "). In English terminology, “glass” may be called DOM (Depth Of Market), Market Depth, OpenBook, or Blotter. It usually looks like the one on the right.For each security traded on the stock exchange, there is its own order queue for buying and selling, which is not related to the order queue for other stocks. And, accordingly, a visual representation of each share displays its own “glass”, which is in no way connected with the “glasses” of applications for other shares.

“Glass” consists of a vertical list, in each line of which there is an application to buy or sell shares, currently issued by one of the brokers. "Glass" is formed only by applications for the purchase or sale of shares with an established price (limit order), i.e. we see them in this “glass”. Each application line contains a limit price and the number of shares (or lots) for buying / selling at this (or better) price. All orders in the “glass” are sorted at the price indicated in the limited order submitted. In this view, the bid price decreases from top to bottom. In the lower part of the “glass” (in the green zone) there are orders for the purchase of shares - Bid , and in the upper part of the “glass” (in the red zone) orders for the sale of shares - Ask (they Offer ) are located.

Note: Sometimes applications in the "glass" depict the opposite in ascending prices from top to bottom. Then the applications for the purchase (Bid) will be at the top of the "glass", and the application for the sale (Ask), respectively, at the bottom. Color marking of applications for the purchase / sale in the "glass" may also differ from that described. It all depends on the settings of the trading terminal, which displays this "glass".The full queue of requests at a given time can be in the table view rather large in height, then in the “glass” not the entire queue is displayed, but only its central part, i.e. N best sell orders and N best buy orders (where N is, for example, 10). The value of N in this case determines the depth of the "glass" and is configured in the trading terminal.

If a limited order (an application with a specified price) to buy or sell arrives in the "glass", then two options are possible. If it intersects at a price with counter orders available in the “glass”, then it is immediately executed (in part or in full). If it does not intersect at the price with the existing counter orders, then it takes its place in the “glass” (in the corresponding position at the price) and waits for counter orders that satisfy it at the price.

For example, if in the situation shown in this illustration, a limited buy order (buy limit order) with a price of $ 35.53 is received, then it will either be immediately fully satisfied (if it contains no more than 485 shares), or (if more than 485 shares) it will be partially satisfied (for 485 shares), and the application for the remaining shares will be queued for a purchase with a price of $ 35.53 - while the boundary between Ask and Bid will move, because the price of $ 35.53 is already included in the purchase requisition (in the green zone).

And if in the situation shown in this illustration, a limited buy order (buy limit order) with a price of $ 35.51 or $ 35.48 is received, then this order will simply fall into the "glass" and wait for the counter order.

Market orders in the "glass" are not delayed, they are executed immediately upon receipt. If a market order to purchase shares (buy market order) arrives in the "glass", then it is immediately satisfied with the best price (at the moment) for the sale of shares. And vice versa, if a market order for the sale of shares (sell market order) is received, then it is immediately satisfied with the best price (at the moment) for the purchase of shares.

If, in the situation shown in this illustration, there is a market request for the purchase of 450 shares, they will immediately be purchased at a price of $ 35.53 per share. And instead of 485 shares at $ 35.53 in the "glass" will be an application for 35 shares at $ 35.53 in anticipation of future counter-deals. With a market bid for sale in the same way: if there is a market bid for the sale of 300 shares, they will immediately be sold at a price of 35.50, and in the “glass” there will be an application for the purchase of 20 shares at 35.50.

If the market order specifies the number of shares more than in the most profitable counter order available in the “glass”, then part of the market order is executed at the price of the best bid, and the rest at the price of the next best bid, etc., until the market bid will be completely fulfilled.

If several similar bids of the same type are placed at the same price, they will be displayed in the “glass” not as separate lines, but as a single line in which the number of shares from these applications will be summed up. And when a counter-order appears, which covers this total number of shares, not wholly, but only partially, the orders will be executed in the order of their receipt (first of all, the order that arrived earlier).

For example, if someone makes an application to purchase 1000 shares of this company at a price of $ 35.50 per share, and then another application comes to buy 800 shares of the same company at the same price of $ 35.50 per share, then in the "glass" these two applications will be Display one line: 1800 shares at a price of $ 35.50 per share. And if then a counter order appears for the sale of 1,500 shares at a price of $ 35.50 per share (or better), then the first purchase request (for 1,000 shares) will be fully completed, and the second (which came later) will be only partially fulfilled (for 500 shares), and the application for the remaining 300 shares will be expected in the queue (in the “glass”) of the next satisfactory counter offer.

Spread (spread, read [spread]) - this is the difference between the maximum bid price for the purchase and the minimum bid price for the sale (at the same time). Visually, the spread is in the center of the “glass”, between bids for buying and bids for selling. In this illustration, the spread is $ 0.03.

Liquidity is an economic term for the ability of assets to be quickly sold at a price close to the market. As applied to stocks and the securities market, the greater the number of transactions (trading volume) for these shares, and the smaller the spread, the greater the liquidity of these shares. If a certain application reduces the spread, then it accordingly increases the liquidity of these shares, and vice versa, if the application increases the spread, then it reduces the liquidity of these shares.

Filling the “glass” with bids and the spread value is constantly changing in real time as brokers submit / withdraw bids and as bids are fulfilled (that is, as purchase / sale transactions are completed on these shares on the stock exchange).

You, as an investor, are unlikely to ever have to deal with the analysis of applications in the “glass”. Usually only active day traders or scalpers track this. For investors who make occasional one-off deals, this is not so important. I described “Glass” here, just to visually explain how the processing of incoming applications for the purchase / sale of shares on the exchange takes place.

Where and how to track stock prices

In the above-mentioned stock exchange terminals there are not only transaction functions, but also information functions for tracking stock prices (both current and time-based). True, the default stock quotes from the NYSE and NASDAQ exchanges there are not displayed online, but with a delay of 15 minutes. In order to see online quotes at stock exchange terminals, usually, in addition to the subscription fee for access to the terminal, you need to additionally pay a subscription fee for access to online stock quotes.

But it’s not necessary to pay for online quotes, especially considering that there are online services where you can track stock prices:All of these services receive stock price data on US stock exchanges (NYSE, NASDAQ) in real time. Therefore, you can always get up to date information about the value of the shares.

But it’s not necessary to pay for online quotes, especially considering that there are online services where you can track stock prices:All of these services receive stock price data on US stock exchanges (NYSE, NASDAQ) in real time. Therefore, you can always get up to date information about the value of the shares.In addition to the value of shares (current and in time schedules) in these services, you can also look at some other financial information on shares: trading volume, change in value for the last trading session, the size and date of dividend payment, news related to the company's financial activities, etc. (somewhere more information, somewhere less). Periodically you can go there and keep track of stocks that interest you.

Which of these services to use, decide for yourself (which is more like). I personally find Google Finance convenient, but I know that Yahoo! Finance is very popular among financiers. Microsoft's financial services for convenience and information content, of course, are losing heavily.

You can easily notice that the graphs of the course do not change smoothly, occasionally breaks (sharp jumps) of the course up or down occur - this is the so-called gap .

What influences the change in the value of shares?

Perhaps this is not an exhaustive answer. The value of shares of a separate company is affected by a huge number of various factors.

- First of all, of course, the financial performance of the company. Often noticeable jumps or drops in stocks occur just after the publication of the company's annual or quarterly financial statements. If the reports showed a good income - the shares grow, showed strong costs - the shares fall.

- Also, the yield or the announcement of a new promising product of the company, on which investors have high hopes for increasing profitability, affects the value of shares.

- Often influenced by large corporate transactions: the purchase of a promising company, the sale of part of the company, mergers, acquisitions and more.

- Announcement of some strategic plans of the company, change of leadership.

- The overall rise or fall of the entire market or a particular industry.

- Local and global financial crises.

- Natural disasters, wars, epidemics in the area where the company's main production facilities are located.

- News about the company's activities and possible financial consequences.

Trading time

Trading session

Trading on the US stock exchanges (NASDAQ, NYSE, AMEX) takes place on weekdays (Monday through Friday) from 9:30 am to 4:00 pm [US Eastern Time] (i.e., from 5:30 pm to midnight Moscow time ). There is no lunch break on the US exchanges (which is noteworthy, there is only a lunch break on Asian markets).

The specified time interval is the time of the trading session itself (Core trading hours) when stock purchase / sale transactions are concluded.

Extended hours

In addition, there are also Extended Hours on US stock exchanges on trading days:

In addition, there are also Extended Hours on US stock exchanges on trading days:- Pre-market - an interval of several hours immediately before the opening of the main trading session.

- After-hours (Post-market) - an interval of several hours immediately after the close of the main trading session.

Pre-market - from 7:00 am to 9:30 am [US Eastern Time] (that is, from 15:00 to 17:30 Moscow time).

After-hours - from 4:00 pm to 8:00 pm [US Eastern Time] (that is, from 00:00 to 04:00 the next day Moscow time).

During these extended hours, exchanges only accept applications from brokers to buy / sell stocks, but the transactions themselves are not conducted at this time. Deals on applications submitted during these extended hours are queued and will be held only during the next trading session.

When can I apply for buying / selling stocks?

An order can enter the exchange system only during the trading session, as well as during the extended trading hours. However, many Russian brokers who provide Russian clients with access to US stock exchanges allow clients to keep their orders with the broker in an interval closer to business hours in Russia, for example, from 9:00 to 24:00 Moscow time. This is done simply for the convenience of customers who want to leave applications during business hours. In this case, such orders are cached on the broker’s side, and they are entered into the exchange system with the opening of the exchange.

But personally, it is more convenient for me to apply when stock exchanges in the USA have already opened. This is just after the end of my working day at the main job, when working fuss no longer distracts from the process of analyzing the market and considering applications for buying / selling stocks.

Weekends and holidays

US exchanges do not work on weekends (Saturday, Sunday), as well as on official US government (federal) holidays .

In the US, most federal holidays are not scheduled for a specific date, but are indicated relative to, for example:

- Martin Luther King Day - the third Monday of January;

- Memorial Day - the last Monday of May;

- Columbus Day - the second Monday of October.

www.nasdaqtrader.com/Trader.aspx?id=Calendar

And on the days of Russian public holidays, if they do not coincide with weekends or American holidays, the US exchanges, of course, work.

Storage of purchased shares

The brokerage company, as a rule, has its own depository (centralized depository of securities, more precisely, a securities accounting center). Together with the signing of an agreement on the provision of brokerage services, the client (trader / investor) also signs an agreement on the provision of custodial (depositary) services with the same brokerage company. Under this agreement, a custodian is opened for the client (aka a custody account, a deposit of securities) in their depository. This custodian “stores” (takes into account) all shares purchased by the client until they are sold or until the shares are transferred to another depository (if the client wants to transfer the shares to another company for storage).

The brokerage company, as a rule, has its own depository (centralized depository of securities, more precisely, a securities accounting center). Together with the signing of an agreement on the provision of brokerage services, the client (trader / investor) also signs an agreement on the provision of custodial (depositary) services with the same brokerage company. Under this agreement, a custodian is opened for the client (aka a custody account, a deposit of securities) in their depository. This custodian “stores” (takes into account) all shares purchased by the client until they are sold or until the shares are transferred to another depository (if the client wants to transfer the shares to another company for storage).When an investor buys shares, in reality no movement of documents takes place. Shares have long existed only in uncertificated form. It’s just that the company that issued the shares makes an appropriate entry in the database of the register of shareholders, which confirms that such and such number of shares now belongs to such and such a client and is stored on such a custodial account in such a custodian bank. Plus, the corresponding entry in the database of the custodian bank itself. The new owner of the shares is entered in the register of shareholders of the company with a delay of three days (T + 3 rule), so traders who open and close their positions on shares within 1-2 days do not even enter the register of shareholders of the company.

Usually, in addition to the local depository of the brokerage company itself, the purchased shares through the chain of accounts of nominal holding are also taken into account in the upstream and more authoritative depository - DTCC (Depository Trust & Clearing Corporation), which is located in the USA (New York). Relatively speaking, in IT terminology (or rather, in the terminology of a hierarchical PKI ), one can imagine that the depositary of a separate brokerage company is an ordinary certifying center, and the superior depository DTCC is the root certification center for stock accounting.

Thus, you will never be able to hold the purchased shares in your hands. Although they are called "securities", but in reality it is not paper for a long time. The time has already passed when the stock of shares was a bundle of rough dense papers with seals, signatures, holograms and watermarks that lay in a personal cell in the shareholder’s safe deposit box of the shareholder. Therefore, if you planned to buy several shares of any company only to hang a beautiful piece of paper in a frame on the wall or to show off to your friends, you can forget about this idea.

It happens that storing shares in a custodian for a client is free of charge, and it happens that for this, a client’s brokerage account is regularly charged for custodial services. If custodial service fees are charged, then it is usually expressed as a small percentage of the total market value of all the shares that are stored in the account. This fee is charged monthly and each month its amount is recalculated depending on the total market value of the shares that are on the custodian on the last day of the month.

If you suddenly need for some purposes a documentary proof of your ownership of any shares, the brokerage company will, upon request, provide you with a paper statement from your custodial account certified by seals and signatures of the managers of the Cyprus brokerage company.

Dividends

Dividends are a part of the company's profits, which are distributed among the shareholders in accordance with their shares. If the profit from the growth of the value of the shares appears only after the sale of the shares, then the dividends are the additional profit that the shareholders receive on the contrary.

Dividends are a part of the company's profits, which are distributed among the shareholders in accordance with their shares. If the profit from the growth of the value of the shares appears only after the sale of the shares, then the dividends are the additional profit that the shareholders receive on the contrary.Dividends are not at all a guaranteed return to shareholders. The company's board of directors regularly decides whether dividends will be paid to shareholders this year, and if so, in what amount.If in one year the company paid dividends to shareholders, in another year the board of directors may decide that there will be no dividend payments (or, on the contrary, they did not pay them before, but then they could start paying them).

Many young and rapidly developing companies do not pay dividends to their shareholders at all, they prefer to invest all profits to the maximum in their development. And older companies, the rapid development of which has already slowed down, for which expansion no longer exists, and whose shares have for a long time kept at about the same level, on the contrary, they often resort to paying dividends in order to increase the attractiveness of stocks for investors.

In the sector of American IT companies (in particular, companies from Silicon Valley), many companies do not pay dividends at all, but there are also those who pay. For example, the following companies do not pay dividends: Google (GOOG), Apple (AAPL), Red Hat (RHT), AMD (AMD), nVIDIA (NVDA), Adobe (ADBE), Yahoo! (YHOO), VMware (VMW); pay dividends of the company: Microsoft (MSFT), Oracle (ORCL), IBM (IBM), Intel (INTC), CISCO (CSCO).

If the company pays dividends, it is usually done quarterly or annually.

The shareholder himself does not need to make any additional manipulations to receive dividends. Information about all shareholders and the number of their shares is in the register of shareholders of the company, on the basis of this information dividends are distributed, which are transferred to the accounts of shareholders (shareholders).

Dividends are usually paid in cash (some dollars or cents per share), in which case an amount proportional to the number of shares purchased will go to the brokerage account of the respective investor.

Less often, dividends can be distributed in the form of shares of a company. In this case, the holder will be credited with a certain number of shares of the company proportional to the number of its shares on his custodial account. The fractional number of shares (the remainder of the dividends payable, less than the cost of one share) will already go in the form of money to a brokerage account.

Dividend payout dates. Who is eligible for dividends?

- Declaration date - the date of the announcement that the company will pay dividends, as well as their size and payment dates.

- Ex-dividend date — . , .

- Record date — . , .

- Payment date — . 1-2 .

The stock price is adjusted down (reduced) by the amount of the declared dividend on the ex-dividend day.

Sale of shares

The process of selling shares is technically no different from the process of buying them. Either make an order for sale through the application (trading terminal), or give instructions to the broker by phone (“by voice”), or through a web terminal.

The process of selling shares is technically no different from the process of buying them. Either make an order for sale through the application (trading terminal), or give instructions to the broker by phone (“by voice”), or through a web terminal.Types of orders for sale (market order, limit order, etc.) have also been described earlier.

After the sale, the shares are deducted from your custodial account, and the profit from the sale less commissions and fees is credited to the brokerage account.

Brokerage Commission for the sale of shares

When a stock is sold to a broker, exactly the same commission is paid as it was with a purchase, i.e. average 1 cent (0.01 USD) per share. In brokerage fees there is usually no separation of brokerage commissions for the purchase and sale, it is simply indicated the brokerage commission for any trade transactions on the stock exchange. It doesn't matter if you sell shares or buy, you will pay a commission of a certain number of cents for each share. Even if previously purchased shares have risen strongly in price, you will pay the same commission to the broker when selling, because it depends on the quantity, not on the market value of the shares.

Exchange fee

In addition to the brokerage commission for the sale of shares will also have to pay an exchange fee (when buying shares it is not). The value of its calculated quite difficult, it depends on the number of shares sold, as well as on whether the application for sale increases or decreases the liquidity. The size of this collection on the American stock exchanges is generally small (in the range of $ 1 to $ 10), with the sale of 1000 shares there will be somewhere $ 2- $ 3, no more.

Sale of shares through another broker

Is it possible to buy shares on foreign exchanges through one brokerage company, and then sell them through another brokerage company?

Yes of course. For this you need:

- Sign a brokerage service agreement, as well as a custodial service agreement with another brokerage company.

- Find out the details of the new custodial account (it is the same account-depot, it is the deposit of securities).

- In the first brokerage company, on the custodians of which shares are placed now, give an order to transfer securities to another custodial account (with indication of its details). The whole procedure of transferring securities to another depositary takes about two weeks.

- After the shares are transferred to the custodial account of a new brokerage company, it is already possible in this second brokerage company, as usual, to give orders for their sale.

Withdrawal from the brokerage account

Directly get money from a brokerage account through a cashier or ATM is impossible. You must first transfer money from your brokerage account to your bank account in any Russian bank. To do this, the brokerage company is instructed to withdraw funds to any bank account.

Directly get money from a brokerage account through a cashier or ATM is impossible. You must first transfer money from your brokerage account to your bank account in any Russian bank. To do this, the brokerage company is instructed to withdraw funds to any bank account.You can withdraw funds either to a bank account in a Russian bank of an investment company (if you opened it to deposit funds), or to any other account in any bank. Well, then already from this bank to receive money using conventional means: in cash through the cashier, and if there is a plastic card, then it is possible both in cash through an ATM, and non-cash card payments.

With a brokerage account can not withdraw money received from the sale of shares immediately after their sale. Before the withdrawal of funds must pass three working days from the date of sale of shares. You can spend this money to buy other shares right away (at least in one order you can immediately indicate the sale of some shares and the purchase of other shares with this money) - such brokers allow, but you cannot immediately withdraw to a bank account.

If you ultimately need to receive these funds not in US dollars, but in another currency (for example, in Russian rubles or euros), then it will be more profitable to do the conversion, on the side of Cyprus:

- First, you give an order to convert funds from a brokerage account from USD to RUR or EUR.

- And only then you give an order to transfer funds from a ruble (or Euro) account in Cyprus to an account in the same currency already in a Russian bank.

In rare cases, if there are relevant agreements between the Cyprus and Russian banks of this investment company, the withdrawal of funds from a brokerage account in Cyprus to a bank account opened by the client in the Russian bank of this company can be without a fee.

Taxes

The topic is quite important, so I devoted a separate chapter to it in my article.

In which countries do you pay taxes?

If you live in Russia and trade shares on the US stock exchanges according to the Cyprus scheme, then:

- In the US, taxes do not need to pay. Firstly, because you are not a US tax resident, and secondly, because you actually earned income not in the United States, but in Cyprus (where a brokerage account is opened).

- In the Republic of Cyprus taxes do not need to pay either. Although you receive income from the sale of shares (as well as, perhaps, income in the form of dividends) in Cyprus, but according to the tax laws of Cyprus, income from dividends and income from the sale of securities is fully exempt from taxes in Cyprus.

- .

(183 ) 12 , [ , .207 .2]. , [ , .209 .1], , , [ , .208 .3].

, [ , .209 .1], , , [ , .208 .3].

Tax rates

- The tax rate on income derived from the sale of shares: 13% [Tax Code, Article 224, paragraph 1].

- The tax rate on income received in the form of dividends: 9% [Tax Code, Article 224, paragraph 4].

The tax base

The tax base is the amount with which the tax is levied. For each type of tax, the tax base is calculated separately.

- : , , () , , , , , .

, . [ , .214.1]. - ( ) [ , .214].

Tax payment procedure

If you entered into a brokerage agreement with a Russian company and your brokerage account was in Russia, then this brokerage company would be recognized as your tax agent, and it would pay all income taxes for you (both from the sale of shares and from dividends). ). And you would have already transferred the amount after taxes. Just as any Russian company-employer is a tax agent for all employees, therefore the company itself pays income tax for all employees, and employees themselves receive wages after deducting income tax.

However, we in this article consider trading stocks under the “Cyprus scheme”. In this case, the brokerage service agreement is concluded with a company registered in Cyprus, and you will receive income to the brokerage account in this Cyprus company. And a foreign company that is outside the Russian Federation does not fall under the jurisdiction of the Russian tax code, i.e. she cannot be your tax agent for paying taxes in Russia.

This means that in this case no one will pay taxes for you. To pay taxes, you yourself must contact the tax authorities at the place of registration, fill out a tax return (form 3-NDFL), indicate on page B there the income received from sources outside the Russian Federation and pay taxes on them.

This means that in this case no one will pay taxes for you. To pay taxes, you yourself must contact the tax authorities at the place of registration, fill out a tax return (form 3-NDFL), indicate on page B there the income received from sources outside the Russian Federation and pay taxes on them.The tax declaration by individuals is submitted to the Inspection of the Federal Tax Service (Inspection of the Federal Tax Service) at the registered place of residence once a year, no later than April 30, in respect of income received for the entire previous year.

The Cyprus brokerage company will not give you any information on form 2-NDFL or 3-NDFL, they can only provide you with a detailed statement of your broker account for the reporting tax period (for the past year), where you will see all the necessary information on your income and expenses, which you can use to fill out a tax return yourself (in the form 3-NDFL).

It is your responsibility to inform the tax authorities of the Russian Federation about the fact that you receive income outside of Russia, as a tax resident of the Russian Federation. No one will do this besides you: neither the Cyprus brokerage company, where the income was received, nor the Russian investment company, through which you entered into an agreement with the Cyprus company.

And many private investors living in Russia and trading in shares on foreign stock markets use this lack of information from the Russian tax authorities, i.e. they simply do not file a tax return, do not report these incomes and therefore do not pay taxes on them. You should know that this is treated as tax evasion from an individual and is a violation of the legislation of the Russian Federation. And if suddenly the Russian tax authorities somehow later become aware of the fact that you did not pay taxes, then you may have problems up to criminal responsibility [Criminal Code of the Russian Federation, Article 1998].

Detailed information on taxes on personal income in Russia can be found here:

Tax Code of the Russian Federation, Part 2, Chapter 23. Personal income tax .

Non-US companies on US exchanges

If the issuing company is outside the United States, i.e. Since its shares have already been issued (emitted), registered and traded on an exchange in another country, these foreign shares cannot be directly traded on US stock exchanges. If the shares of this foreign (relative to the United States) companies want to bring to the American stock markets to attract American investors, then this is usually done through the issuance of American derivative securities (derivatives). As such derivatives use ADRs ( ADR , ADR ).

To this end, in the country of the issuer (the company that issued the shares) a part of the company's shares are deposited (placed in custody) in a custodian bank licensed by the United States. A custodian bank is a bank responsible for safekeeping of securities in the country where they were issued. The custodian bank is listed in the shareholder register of the issuing company as the nominal holder of these shares.

To this end, in the country of the issuer (the company that issued the shares) a part of the company's shares are deposited (placed in custody) in a custodian bank licensed by the United States. A custodian bank is a bank responsible for safekeeping of securities in the country where they were issued. The custodian bank is listed in the shareholder register of the issuing company as the nominal holder of these shares.At the same time, a certain American depositary bank, which has a contractual relationship with a custody bank in the issuer's country, issues a corresponding number of American depositary receipts (ADRs) for the amount of shares deposited. One ADR may be equivalent to one share, part of a share, or several shares of a foreign issuing company.

Thus, ADRs are derivative securities (derivatives) for shares issued outside the United States. This paper confirms the ownership of its owner to the number of shares of a foreign issuer indicated in the certificate. For the ADRs themselves, the issuer is the American Depositary Bank (95% of ADR issues are accounted for by three banks: Bank of New York, Citibank, JP Morgan Chase), and ADRs are already denominated in USD, therefore these derivative securities can be freely traded on US stock exchanges as shares of US issuing companies. From the point of view of a participant in the US stock markets, ADR can be regarded as ordinary shares, since their buying and selling is no different from buying / selling common stocks of American companies.

In this scheme, the two banks mentioned (one in the USA and the other in the country of the company issuing shares) are essentially intermediaries between the investor / trader who bought ADRs on the US stock exchanges and the company that issued the shares outside the United States. Through these intermediaries, the register of shareholders is kept through ownership of ADRs, the transfer of financial information to the owners of ADRs, as well as dividends and other property rights on the relevant shares.

For example, here are a few non-US companies that have issued shares in their own country, and these shares are listed on the stock exchange in their country: Hitachi, Ltd. ( TYO: 6501 ), Sony Corporation ( TYO: 6758 ), Panasonic Corporation ( TYO: 6752 ), Toyota Motor Corporation ( TYO: 7203Honda Motor Co. LTD. ( TYO: 7267 ).

But the ADRs for these shares, which are traded on the New York Stock Exchange (NYSE): Hitachi, Ltd. (ADR) ( NYSE: HIT ), Sony Corporation (ADR) ( NYSE: SNE ), Panasonic Corporation (ADR) ( NYSE: PC ), Toyota Motor Corporation (ADR) ( NYSE: TM ), Honda Motor Co. LTD. (ADR) ( NYSE: HMC ).

Shares of a number of Russian companies in addition to Russian exchanges are also represented on American exchanges in the form of ADRs. For example, on the NYSE, ADRs of Russian companies are traded: Vimpelcom ( NYSE: VIP ), MTS ( NYSE: MBT ) and Mechel ( NYSE: MTL). Earlier, shares of Russian companies Rostelecom (NYSE: ROS) and Wimm-Bill-Dann (NYSE: WBD) were also present on the NYSE in the form of ADR. But these companies delisted their ADRs on the NYSE, i.e. gone from this exchange (while Wimm-Bill-Dann sold all its ADRs to PepsiCo).

There are also companies operating in Russia, but resident in other countries. For example, the Russian media holding CTC Media (owner of the Russian TV channels CTC, Domashniy and DTV) is registered in the United States, and therefore puts its shares ( NASDAQ: CTCM ) on the NASDAQ exchange directly, without ADRs, like any other public company from the United States.