Rise and fall. Market price of $ 50 million per month

Surprisingly, the rise and fall of the market with a turnover of $ 50,000,000 per month remained completely unnoticed. Market driven installations for iOS.

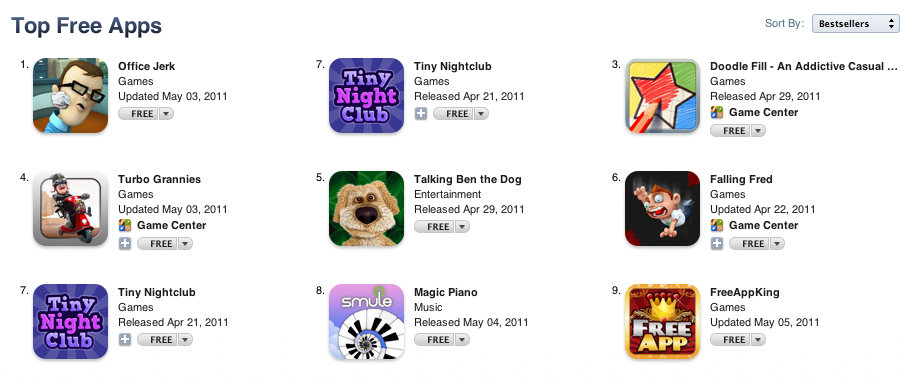

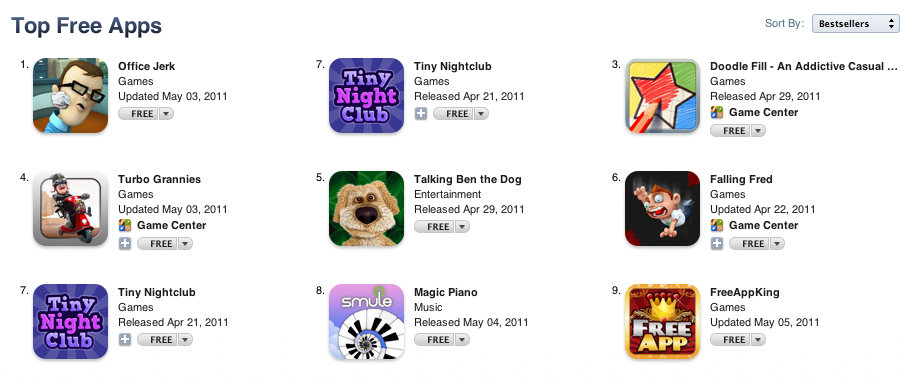

In recent months, marketing chaos has become commonplace in the US top of free iOS apps. Companies compete with promotion methods and budgets in order to rise higher in the ratings, get in the eyes of millions of users who view the AppStore daily and get their own portion of “human flow”.

The system of getting into the rating is very simple 1 . Some time rating in the AppStore was based on the number of installations of a particular application, which means that the top was the one who was able to pay the largest number of installations using a media resource or, more often, advertising networks.

')

About advertising networks and an amusing situation in this market will be discussed further.

Advertising networks such as TapJoy , Flurry , w3i , and about a dozen other networks are mushrooming in the last three months. With them you can always, and, more precisely, could buy 50-150 thousand units per day 2 at the piece-rate price.

The opportunity to invest money and get quick and predictable returns everyone liked:

and advertising companies and publishers who want to promote their products.

This market began its existence just over a year ago, in the spring. Of course, the company TupJoy existed before that, as there were individual developers who invested money in advertising. However, these were quite different heights than those that the company conquered later.

In the spring of last year, one thing appeared on the market, a seemingly not very outstanding application - Zombie Farm.

It is remarkable that its owners were one of the first to understand the effectiveness of 3 outputs in the top 25 4 and began to accumulate an audience - from time to time they started advertising campaigns with the help of the notorious tapjoja. Seeing the success of the application, gradually began to appear a variety of clones that tried to work along the same lines. Strangely enough, it worked for everyone - iOS is a market unique in its monetization.

The summer did not bring any events, but with the onset of autumn several advertising companies appeared at once, ready to provide installations to everyone and everyone ...

And then the market broke.

More and more companies began to earn serious money and re-invest

much of the profit in advertising. The number of companies, along with the amount of earnings, grew until it was revealed that ALL the top of the free ranking was actually quite

not so free.

And at that time, while some companies temporarily stopped directing their cash flow to participate in an incorruptible rating, others happily picked up the championship relay and successfully “stuck” in the mentioned rating.

Such "happiness" of course could not last forever and the first half of April of this year lit up the long-awaited thunderstorm.

Apple considered that such an influence on the rating was not good for anyone other than Apple itself, and started blocking updates to applications that host such ads. This led to the panic of all participants in a good life rating.

Rumor has it that Scott Forestall collected representatives of advertising companies and “suggested” to temper appetites with space to the top 25 - that is, to “slow down” the advertisement when the application reached the top 26, or simply to limit the number of installations available during the period.

True or not, the future will show, but already now, during the last week, Apple definitely does something with the top and this “something” does not please anyone of those who have been there before. Not like those who are still trying to be there, despite the rapid tightening of available resources.

Most of all, what was happening hit the clone makers 5 and the few top advertising companies that had most of the power on iOS — in particular, TapJoy and Flurry, which, although under the influence of circumstances, tried to rebuild resources, but they didn’t succeed much.

Nevertheless, it was a very interesting period, during which mobile appstores received a powerful evolutionary kick in the ass, while at the same time allowing them to puff up and collapse the bubble of offers under iOS.

1) Spring 2010 - Spring 2011. In our industry, the year counts as 3: irony:

2) To take the numbers: 50 thousand downloads from the US during the day would provide you with a place in the top 25 free applications, which in turn would affect the top income.

3) Usually, with the purchase of installations you will have ~ 10% of the audience. We bought 100 thousand, 10,000 of them lasted more than three minutes. The idea of getting to the top is to get as many “natural” installations as possible, i.e. users who downloaded your application from interest, stayed to play, bought something and told friends.

4) It is exactly the number of applications (25) that by default is shown in the rating, if you enter it from the phone; therefore, most campaigns are launched to reach exactly these places (only top 5 and top 1 are steeper).

5) Simple calculation: he created a farm, invested $ 100k, earned $ 300k in a few months, created a clone of his farm, and repeated.

In recent months, marketing chaos has become commonplace in the US top of free iOS apps. Companies compete with promotion methods and budgets in order to rise higher in the ratings, get in the eyes of millions of users who view the AppStore daily and get their own portion of “human flow”.

The system of getting into the rating is very simple 1 . Some time rating in the AppStore was based on the number of installations of a particular application, which means that the top was the one who was able to pay the largest number of installations using a media resource or, more often, advertising networks.

')

About advertising networks and an amusing situation in this market will be discussed further.

Advertising networks such as TapJoy , Flurry , w3i , and about a dozen other networks are mushrooming in the last three months. With them you can always, and, more precisely, could buy 50-150 thousand units per day 2 at the piece-rate price.

The opportunity to invest money and get quick and predictable returns everyone liked:

and advertising companies and publishers who want to promote their products.

A little excursion into the history:

This market began its existence just over a year ago, in the spring. Of course, the company TupJoy existed before that, as there were individual developers who invested money in advertising. However, these were quite different heights than those that the company conquered later.

In the spring of last year, one thing appeared on the market, a seemingly not very outstanding application - Zombie Farm.

It is remarkable that its owners were one of the first to understand the effectiveness of 3 outputs in the top 25 4 and began to accumulate an audience - from time to time they started advertising campaigns with the help of the notorious tapjoja. Seeing the success of the application, gradually began to appear a variety of clones that tried to work along the same lines. Strangely enough, it worked for everyone - iOS is a market unique in its monetization.

The summer did not bring any events, but with the onset of autumn several advertising companies appeared at once, ready to provide installations to everyone and everyone ...

And then the market broke.

More and more companies began to earn serious money and re-invest

much of the profit in advertising. The number of companies, along with the amount of earnings, grew until it was revealed that ALL the top of the free ranking was actually quite

not so free.

And at that time, while some companies temporarily stopped directing their cash flow to participate in an incorruptible rating, others happily picked up the championship relay and successfully “stuck” in the mentioned rating.

Thunderstorm

Such "happiness" of course could not last forever and the first half of April of this year lit up the long-awaited thunderstorm.

Apple considered that such an influence on the rating was not good for anyone other than Apple itself, and started blocking updates to applications that host such ads. This led to the panic of all participants in a good life rating.

Rumor has it that Scott Forestall collected representatives of advertising companies and “suggested” to temper appetites with space to the top 25 - that is, to “slow down” the advertisement when the application reached the top 26, or simply to limit the number of installations available during the period.

True or not, the future will show, but already now, during the last week, Apple definitely does something with the top and this “something” does not please anyone of those who have been there before. Not like those who are still trying to be there, despite the rapid tightening of available resources.

Most of all, what was happening hit the clone makers 5 and the few top advertising companies that had most of the power on iOS — in particular, TapJoy and Flurry, which, although under the influence of circumstances, tried to rebuild resources, but they didn’t succeed much.

Nevertheless, it was a very interesting period, during which mobile appstores received a powerful evolutionary kick in the ass, while at the same time allowing them to puff up and collapse the bubble of offers under iOS.

Footnotes

1) Spring 2010 - Spring 2011. In our industry, the year counts as 3: irony:

2) To take the numbers: 50 thousand downloads from the US during the day would provide you with a place in the top 25 free applications, which in turn would affect the top income.

3) Usually, with the purchase of installations you will have ~ 10% of the audience. We bought 100 thousand, 10,000 of them lasted more than three minutes. The idea of getting to the top is to get as many “natural” installations as possible, i.e. users who downloaded your application from interest, stayed to play, bought something and told friends.

4) It is exactly the number of applications (25) that by default is shown in the rating, if you enter it from the phone; therefore, most campaigns are launched to reach exactly these places (only top 5 and top 1 are steeper).

5) Simple calculation: he created a farm, invested $ 100k, earned $ 300k in a few months, created a clone of his farm, and repeated.

Source: https://habr.com/ru/post/119096/

All Articles