Apple vs Microsoft

A little less than a year ago, Wall Street in the battle of Microsoft vs Apple for the first time estimated Apple 's market value above Microsoft .

Apple's market capitalization (the total value of all shares) exceeded the capitalization of Microsoft, although the latter company had more revenue and twice as much profit as Apple. Clearly, Wall Street looks at the company's potential growth, not its current revenues, which is why Apple looks like a more attractive company.

')

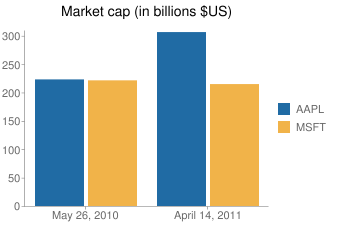

Market capitalization

Although the cost of Microsoft and Apple were very close last spring, now everything is different. Since May 26, 2010, when Apple first overtook Microsoft, Apple’s market capitalization has grown from $ 223 billion to more than $ 306 billion (as of April 14, 2011). Microsoft's capitalization, meanwhile, fell slightly from $ 219 billion to $ 212 billion.

Bottom line : Wall Street currently believes Apple has a higher growth potential than Microsoft. Investors last year made a correct prediction about both companies, but only time can show how companies justify their high cost.

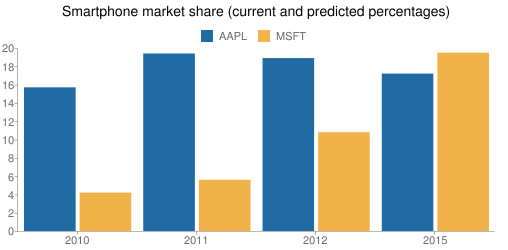

Market share

In addition to Wall Street data, how is the company fighting for users? Microsoft holds the leading role in the desktop operating system business, holding approximately 92% of the market from 2005 to 2009 (the latest available data from IDC). The share of Mac OS X ranged from just 3.5% to 4.0%.

Apple grabbed a significant share of the smartphone market — 15.7% of the global market share last year, compared with 4.2% of Microsoft’s share. However, according to Gartner and IDC , Windows Phone will beat iOS in 2015, taking 19.5% of the market share against 17.2% from Apple.

Source: Gartner Inc.

In addition, according to IDC, Apple was in the lead with an 87.4% share of the global tablet market last year. Gartner predicts that Apple will hold 69% of the market this year and another 47% by 2015. Windows in this forecast does not appear at all.

The bottom line : a number of influential analysts believe that Microsoft should ultimately come out on top in such a fast-growing area as smartphones. In another area - tablets, for Microsoft there is no way. However, Microsoft has maintained its huge position in the desktop market.

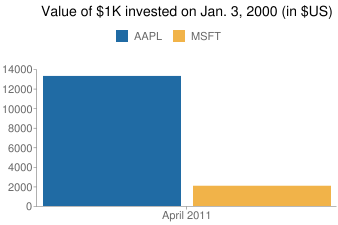

Long-term investment value

If you invested $ 1000 in each company's shares on January 3, 2000, what would you get in April 2011? Considering the split of the stock, and, in the case of Microsft, dividends, but not including taxes and deductions to brokers, you would receive $ 2072 from Microsoft and $ 13294 from Apple.

Source: Reuters, Yahoo Finance, Computerworld

If you invested $ 1,000 in each of these companies on May 26 of last year, your Apple stock would be worth $ 1,427 in mid-April, while the price for your Microsoft stock would be $ 1,033.

Bottom line : Apple has been an excellent investment for the past ten years.

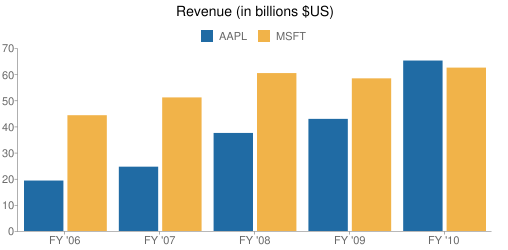

Income

Microsoft’s revenue in 2006 was twice as much as Apple’s revenue in the same year: $ 44 billion versus $ 19.3 billion. What is happening now? Apple’s revenues more than tripled, while Microsoft’s revenues grew by less than 50%.

Bottom line : Apple’s revenue in 2010 slightly exceeded Microsoft’s revenue, Apple’s $ 65.2 billion from Microsoft’s $ 62.5 billion (note: Microsoft’s reporting period is July-June, while Apple’s is October-September).

Source: company websites, SEC data, Reuters. Microsoft’s reporting period ends on June 30, while Apple’s reporting period ends on September 30.

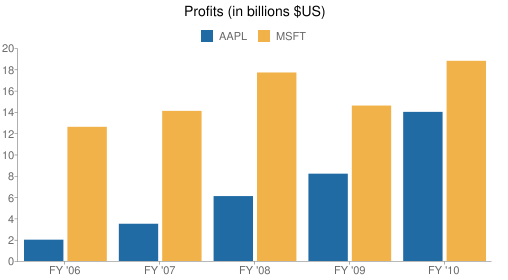

Profit

In 2006, Microsoft had six times more profit than Apple. Net profit from Apple subsequently increased sevenfold, while Microsoft only by about 50%.

Bottom line : While Microsoft is making more profit than Apple, but over the past few years the gap has narrowed dramatically. If current trends continue (and it’s very likely that they will), then Apple, along with Microsoft, will be at the top of the bottom line.

Source: company websites, SEC data, Reuters. Microsoft’s reporting period ends on June 30, while Apple’s reporting period ends on September 30.

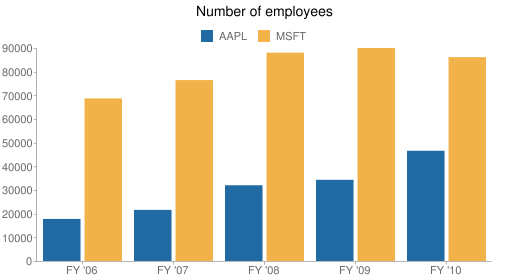

The number of employees

Microsoft still employs significantly more people than Apple, although Microsoft’s frame rate dropped slightly from 93,000 in 2009 to 89,000 in 2010. Apple staff, on the contrary, is growing: there was a significant jump from 34,300 employees in 2009 to 46,600 in 2010.

Bottom line : Apple’s revenue per employee at the end of 2010 was significantly higher than that of Microsoft: $ 1.4 million versus $ 702,000. In addition, Apple's profit per employee was $ 3,00429 against Microsoft's $ 211,236.

Source: company websites, SEC data, Reuters. Microsoft’s reporting period ends on June 30, while Apple’s reporting period ends on September 30.

Conclusion

So what is the result? Apple attracts investors much more than Microsoft, despite the fact that the latter is larger (company size) and continues to dominate the desktop market. Apple’s ability to create a special, new category of devices, like the iPhone and iPad (and the iPod, as it was several years ago), carries much more weight on the market than the steady stream of revenues from Microsoft’s already mature market. However, experts believe that Microsoft will overtake Apple in the smartphone market.

Some years ago it was believed that Apple’s value may be overstated , but so far no serious evidence has been provided.

Mari Keefe collected most of the data for this report.

Sharon Machlis is the chief editor of ComputerWorld. Its address is smachlis@computerworld.com. You can follow her twitter: @ sharon000 , on her Facebook page or subscribe to her RSS feed: articles | blogs .

Source: https://habr.com/ru/post/119046/

All Articles