How to live happily while paying taxes

Terrible truth

You do not pay taxes, because it is difficult, incomprehensible and generally unpleasant? It's true. Each startup has its own, often quite insane mission. We, the Elba startup , are also very simple - to make sure that you are not afraid of taxes and accounting and at the same time continue to remain yourself - a person who wants to do his own business and earn.

Today we have a case for you! This means that together we will look at a specific situation and understand why paying taxes and accounting is simple, although initially it seems that this is a nightmare.

Do not be surprised if you have already seen exactly the same post on Friday, then we just did not understand, but do not want to deprive the audience of the content and now we publish it today.

Immediately the announcement: the next time we are in the format of a similar case, we will tell you how to become a “white” simple freelancer or an ordinary small entrepreneur. Do not miss!

')

Now we will have a case about why it is easier to pay a little bit of money and be white if you just rent an apartment to someone. Such is a simple example in which we will together figure out how to determine the amount of tax and what to do next. Just an example that is very typical for almost any type of business activity.

In Moscow, more than a hundred thousand people rent apartments, and most of them probably commit a terrible crime - they do not pay taxes. The game is not worth the candle - only about six percent, you are an honest citizen ... and you can sleep peacefully.

Details

Suppose Vasya rents an apartment in Moscow and receives from this 30,000 rubles a month. Vasya, as an honest person, is officially registered as an individual entrepreneur (IP) (this is done on our website for free), and now there are two things: regularly removing some taxes from the state and donating a dozen pieces of paper every year, which he hasn’t has a clue. At all.

Do not need!

According to the concepts

First, we will define the concepts if someone did not know, and even forgot. The simplified taxation system (STS) is when you do not keep complicated accounting and pay simple taxes . There is a simplified tax system of 6% when you pay 6% of turnover taxes, or a simplified tax system of 15%, when you deduct all expenses from the proceeds and pay 15% of the net profit. Six or fifteen - to choose from, but it is necessary during registration of the PI to tell about this tax.

In addition, there is the Pension Fund of Russia - PFR. He also wants some money. We will tell you how much, as well as how to do it so that he does not want too much. This is the nature of our service - we honestly tell everything. We are good.

Money - let's calculate how much Vasya owes taxes and fees

30 thousand rubles of rent per month is 360 thousand rubles a year. Vasya's simplified tax system has exactly 6% (the most logical in his case): the costs for renting an apartment are few and easier to pay 6% than 15%. Six percent of 30 thousand is 1 800 rubles per month or 21 600 rubles per year - this is your taxes. By the way, all this “Elba” itself will count for Vasily, you can not learn unnecessary intricacies.

Upon seeing Vasina 360,000 rubles, we will immediately tell Vasya that he also has 16,048 rubles from the Pension Fund (since 2011, and before that there was another money, but we are closely monitoring the situation and always and we consider everything right). This amount does not depend on anything at all; Vasya simply owes it to the state, because he is an entrepreneur, and because 2011 has come. Do not think about the nature of this amount - we have already thought and that is enough.

16,048 rubles is a lot, but Vasya is great and therefore we are pleased to inform him:

The amount in the tax can be reduced by the amount of tribute to the Pension Fund. However, to reduce the tax, more than half can not.

As a rule, Vasya does not know this, and we tell him such tricks wherever they are - this is valuable. Do not think about this nonsense, we all know and will automatically help you.

Payback - when, how much, how and where to pay

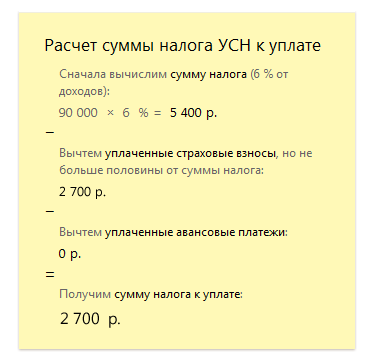

The tax is usually paid once a quarter, in this case 6% of the revenue (30,000 rubles × 3 months = 90,000 rubles) in the last quarter. Total, the tax will be 5 400 rubles. This amount should be reduced by the amount of payment to the FIU (4,012 rubles per quarter).

Thus, Vasin quarterly payment to the tax is equal to 2,700 rubles (reduced 5,400 by no more than half), and another 4,012 rubles - a quarterly payment to the FIU. As a result, the total annual payment to the tax and FIU will be: (2,700 + 4,012) × 4 = 26,848 rubles. In a month - 2 237 rubles.

It seems that your brain is already melting and you do not want to know all this ... But for us everything is very simple! This is how this calculation looks in Elba:

If Vasya was not an individual entrepreneur, but simply an individual, it would have cost him more: 30,000 × 13% (personal income tax) = 3,900 per month. Becoming a PI , you pay almost half the taxes. At the same time, one should not forget that Vasya makes payments to the Pension Fund not as a charitable aid to the state, but in order for him to accumulate a pension. In addition, Vasya needs an officially confirmed income, because he does not work anywhere else and wants to take a loan for a car - yes, now he can buy a car!

By the way, “Elba” will not only calculate taxes, but also help pay them. You simply indicate all the incomes, and we will say how much to pay taxes and a completed receipt for payment will immediately come out of your printer. Or maybe it will even be a payment for online banking - as you wish.

"A bunch" of paperwork - will it?

Paying taxes is scary, not only because the money goes to where it is not clear. The horror and causes the number of mysterious waste paper, while created. But with "Elba" all this nonsense will not touch you. We will do everything for you as a friend.

Once a year, the entrepreneur submits a tax return for the simplified payment. “Elba” will prepare and send it via the Internet directly to the tax office, without even getting up from the chair. No kidding - no need to go anywhere.

In addition, once at the end of the year, it is necessary to prepare declarations on forms RSV-2 and SZV 6-1 to the Pension Fund. Elba will do all this for Vasya too, he will only need to heroically press the “Next” button. As in the first case, the declaration to the Pension Fund Elba, send with-by-sama! Rest.

Also, once a year it will be necessary to compile and submit information about the average number of employees at the Vasin enterprise. Strangely enough, this information is also sent to the tax office - for some reason they want to know. Vasya’s employees are nil, “Elba” will reflect this in the declaration and also send via the Internet. Continue to enjoy your holiday in perfect mood. It has passed!

If you had land, you would have to pay land tax. There is no land - no tax either. Property tax on Vasin special tax regime is also not paid. "Elba" will allow all this to know for sure and not to think about extra taxes.

Thus, with revenues of 360,000 rubles a year, Vasya needs to pay 26,848 rubles of taxes, fill out three pieces of paper for the year and send them over the Internet. We will do everything for you, through the Internet, where we will send them, we will generate bills at the right time.

Even if you want, we are also ready to bother you with sms, so that you do not forget anything.

A happy ending

In addition, we are able to still a million useful things, and by the end of next year we plan to bring this number to two million, as we are rapidly developing.

Now look at our website at www.e-kontur.ru and wait for the next series in a week, where we will discuss as a real freelancer, not just a spherical landlord of an apartment, live peacefully and do not be afraid of anything.

And very much at last

We wrote all this not to scare (this is not our business ;-), but with the aim of giving the opportunity to make a sensible choice. What will happen to Vasya if he gets caught at work in the "rough"?

First of all: an unpaid tax on the income of an individual will be levied on him - 360,000 × 13% = 46,800 rubles. Then he will be fined for not submitting the personal income tax declaration to 5% of the amount of tax, but not less than 1000 rubles and not more than 30% of the amount of tax. In our case - 2 340 rubles. And finally, the fine for doing business without registration ranges from 500 to 2,000 rubles.

Vasya’s expenses per year will be 46,800 + 2,340 + 500 (optimistic :)) = 49,640 rubles. In fact, 50 thousand (or 4,167 rubles per month), plus a damaged reputation. And if Vasily was an honest entrepreneur, he would pay 2,237 rubles of taxes every month and another 300 rubles for Elba. And do not forget, Vasya also increases the pension for this money, plus he does not spend half his life in the courts.

And yes, “Elba” costs only 300 rubles a month for individual entrepreneurs, and even less if they pay for one year at a time.

In this optimistic scenario, we did not consider the option when it comes to criminal responsibility under article 198 of the Criminal Code of the Russian Federation “Evasion from paying taxes and (or) fees from an individual”:

“Evasion from payment of taxes and (or) fees from an individual by failure to submit a tax return or other documents, the submission of which in accordance with the legislation of the Russian Federation on taxes and fees is mandatory, or by including in the tax return or such documents deliberately false information committed on a large scale - shall be punished with a fine in the amount of from one hundred thousand to three hundred thousand rubles, or in the amount of the salary or other income of the convicted person for the period from one year to two years, or Resto for a period of four to six months, or imprisonment for up to one year. "

As citizens, who are familiar with the practical application of all these terrible laws, absolutely rightly note, the matter will hardly come to courts and sentences. However, this possibility is quite there and we watched it.

If the reason why you do not pay taxes lies only in the complexity of accounting and the incomprehensible method of determining “how much you have to pay”, then there is no such problem - we have it, the Elba project and our website www.e-kontur.ru ;-)

We help with advice, our services cost only 300 rubles a month and less, we are well versed in accounting and finance, helping you not to deal with all this nonsense.

Publications from the series

- How to live happily while paying taxes

- Small business 2011. Wolf and sheep

- About freelancer Ivan and how he did not get up from the couch

Source: https://habr.com/ru/post/110399/

All Articles