What is ABBYY FormReader and how it works in Alfa Bank

We have already talked a lot about products for developers and end users, but we have never talked about solutions for entire companies. Fixed: today's post about ABBYY FormReader - a system for inputting forms filled out by hand or on a printer using ICR (Intelligent Character Recognition) technology. And we will talk about it on the example of implementation in Alfa Bank.

Automation of work with documents in Alfa-Bank is perhaps the most ambitious and most complex project that ABBYY has implemented in the banking sector. This story began in 2005, when the bank decided to create an electronic archive of documents of private clients. It was necessary in order, on the one hand, to reduce the cost of maintaining the archive, and on the other - to reduce the time for searching for documents. There were two “candidates” for this task: AutoStore, a solution from Hewlett Packard, and ABBYY FormReader, which was supposed to be implemented simultaneously with the IBM Content Manager electronic archive system. ABBYY solution fully met all the requirements of the bank, in addition, we were ready to modify the product for specific project tasks, so the choice fell on ABBYY FormReader, or rather, on ABBYY FormReader 6.5 Enterprise Edition .

At that time, Alfa-Bank kept client records in paper form and, therefore, it took from one and a half to several months to parse documents, compile inventories, register and catalog one client file. To get information from the archive, employees needed to make requests, look for a document in a paper archive and make a copy — it took one or even two working days. It was a long and uncomfortable. After implementing FormReader and creating an electronic archive, it takes 80% less time to work with archived documents.

')

In 2007, the bank needed to automate the process of reviewing loan applications. At that time, applications for a loan and a package of documents required for obtaining a loan were sent from the regional branches of the bank to the central office by mail. Then these data were manually entered into the scoring system (a special system in which the borrower’s “reliability” is assessed according to several parameters and the decision to issue a loan is made). It turned out, as you know, not fast.

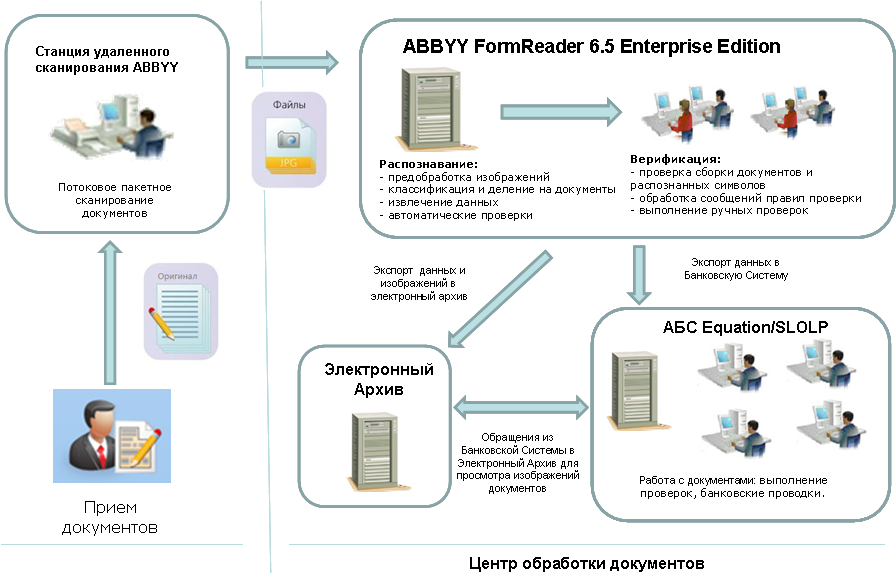

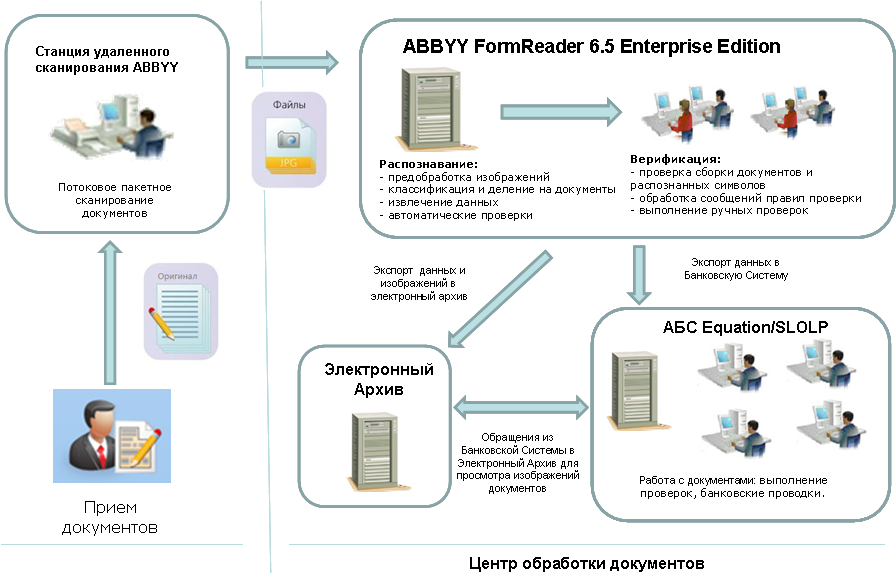

After implementing FormReader, the process began to look like this:

Documents are scanned at regional offices and sent as images to a Processing Center located in Moscow. Here, loan applications are recognized and verified (that is, the operator looks at the recognition result and the scanned image and checks whether the program “read” all the data correctly, whether the order of the pages is preserved in multi-page documents, etc.). Then, together with scanned copies of the attached documents (certificates, passports, etc.), the applications arrive in the scoring system. All together, this is called the “loan conveyor” - and indeed, the work goes quickly, as in the real conveyor. Now, decisions on granting a loan are made 5 times faster, while the costs of processing loan applications have decreased by 60%. Scanning stations are equipped in more than 300 branches of Alfa Bank throughout Russia, and more than 600 users have access to the system. The capacity of the system is 2 million documents per year - about 30 million sheets.

At the third stage of the project, in 2009, the input of corporate clients - legal entities into the electronic archive was automated. Previously, the legal files of clients, settlement documents and documents on currency transactions were kept in paper form. It took from one and a half to several months to parse documents, compile inventories, register and catalog one client profile. When streaming was added to the archive, the time spent by bank employees on working with these documents decreased by an average of 80%.

How it works: FormReader recognizes the type of documents (charter, statement, payment order), as well as their attributes (numbers and dates of contracts, etc.) and sends this data to the archive, this allows you to find the necessary file in a few seconds. Our product processes more than 500 thousand pages per month - about 6 million pages per year. Now all documents in the corporate block of Alfa Bank are processed centrally.

The results of the work are usually evaluated in figures - there are few of them in this project. For example, the number of transaction officers involved in the processing of customer payment documents decreased by 30%, while the number of documents processed by one transaction operator increased by 40%. Now the tellers are completely interchangeable and it is possible to redistribute tasks from one site to another in case of business need.

Our work at Alfa Bank is unique, we have never done anything like this before, and there is no such system — the archive plus geographically distributed streaming — in any other Russian bank. It seems to work out pretty well :)

Sveta Luzgina

Corporate Communications Service

With the support of corporate projects

Automation of work with documents in Alfa-Bank is perhaps the most ambitious and most complex project that ABBYY has implemented in the banking sector. This story began in 2005, when the bank decided to create an electronic archive of documents of private clients. It was necessary in order, on the one hand, to reduce the cost of maintaining the archive, and on the other - to reduce the time for searching for documents. There were two “candidates” for this task: AutoStore, a solution from Hewlett Packard, and ABBYY FormReader, which was supposed to be implemented simultaneously with the IBM Content Manager electronic archive system. ABBYY solution fully met all the requirements of the bank, in addition, we were ready to modify the product for specific project tasks, so the choice fell on ABBYY FormReader, or rather, on ABBYY FormReader 6.5 Enterprise Edition .

At that time, Alfa-Bank kept client records in paper form and, therefore, it took from one and a half to several months to parse documents, compile inventories, register and catalog one client file. To get information from the archive, employees needed to make requests, look for a document in a paper archive and make a copy — it took one or even two working days. It was a long and uncomfortable. After implementing FormReader and creating an electronic archive, it takes 80% less time to work with archived documents.

')

In 2007, the bank needed to automate the process of reviewing loan applications. At that time, applications for a loan and a package of documents required for obtaining a loan were sent from the regional branches of the bank to the central office by mail. Then these data were manually entered into the scoring system (a special system in which the borrower’s “reliability” is assessed according to several parameters and the decision to issue a loan is made). It turned out, as you know, not fast.

After implementing FormReader, the process began to look like this:

Documents are scanned at regional offices and sent as images to a Processing Center located in Moscow. Here, loan applications are recognized and verified (that is, the operator looks at the recognition result and the scanned image and checks whether the program “read” all the data correctly, whether the order of the pages is preserved in multi-page documents, etc.). Then, together with scanned copies of the attached documents (certificates, passports, etc.), the applications arrive in the scoring system. All together, this is called the “loan conveyor” - and indeed, the work goes quickly, as in the real conveyor. Now, decisions on granting a loan are made 5 times faster, while the costs of processing loan applications have decreased by 60%. Scanning stations are equipped in more than 300 branches of Alfa Bank throughout Russia, and more than 600 users have access to the system. The capacity of the system is 2 million documents per year - about 30 million sheets.

At the third stage of the project, in 2009, the input of corporate clients - legal entities into the electronic archive was automated. Previously, the legal files of clients, settlement documents and documents on currency transactions were kept in paper form. It took from one and a half to several months to parse documents, compile inventories, register and catalog one client profile. When streaming was added to the archive, the time spent by bank employees on working with these documents decreased by an average of 80%.

How it works: FormReader recognizes the type of documents (charter, statement, payment order), as well as their attributes (numbers and dates of contracts, etc.) and sends this data to the archive, this allows you to find the necessary file in a few seconds. Our product processes more than 500 thousand pages per month - about 6 million pages per year. Now all documents in the corporate block of Alfa Bank are processed centrally.

The results of the work are usually evaluated in figures - there are few of them in this project. For example, the number of transaction officers involved in the processing of customer payment documents decreased by 30%, while the number of documents processed by one transaction operator increased by 40%. Now the tellers are completely interchangeable and it is possible to redistribute tasks from one site to another in case of business need.

Our work at Alfa Bank is unique, we have never done anything like this before, and there is no such system — the archive plus geographically distributed streaming — in any other Russian bank. It seems to work out pretty well :)

Sveta Luzgina

Corporate Communications Service

With the support of corporate projects

Source: https://habr.com/ru/post/107958/

All Articles