Yandex. Direct. Analyzing the competitive environment

Imagine the situation. You are developing sites. Good sites for good people. Your advertising campaigns have been working for a long time, you have reached a good level of ROI, orders are sent with enviable periodicity. Everything seemed to be good, until one day we received a bunch of letters from Direct, that we were driven out of our familiar positions by someone. We go to the issue and see on our favorite position an unfamiliar competitor site. Our natural desire will be to find out what kind of fruit it is and on the basis of this information to make a strategic decision - whether to get involved in a budget war (if it is a serious and fat competitor) or back up from below and help drain the budget (if it is small things).

“But this is impossible!” - you will say. - “Any contextual advertising system is guided by the principles of a closed auction and does not provide information about its competitors to its advertisers. We do not know either the key competitor requests or the settings of its RC. We do not know it uses negative keywords or quotes . The most important thing is that we do not know his rates and CTR. ”

Calm, only calm! (with)

')

In the article I will tell you how, by indirect evidence, to find out the maximum of strategically important information about competitors, sufficient for making decisions.

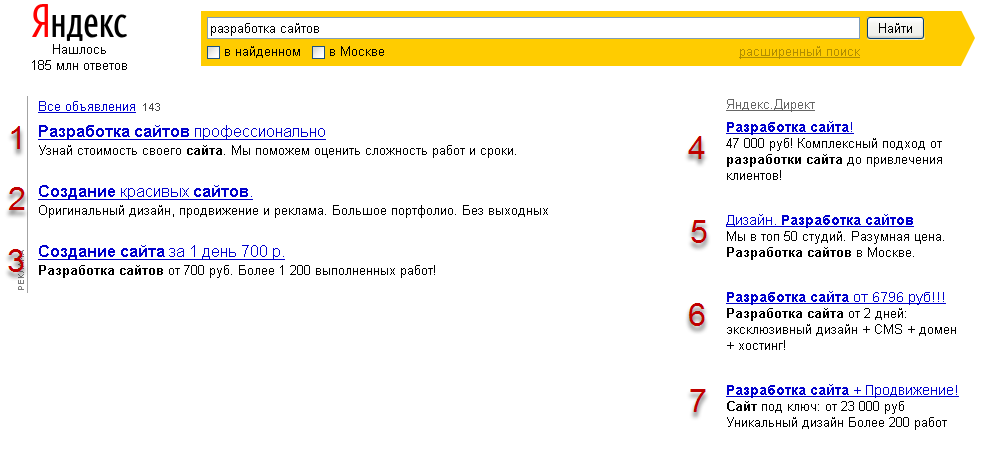

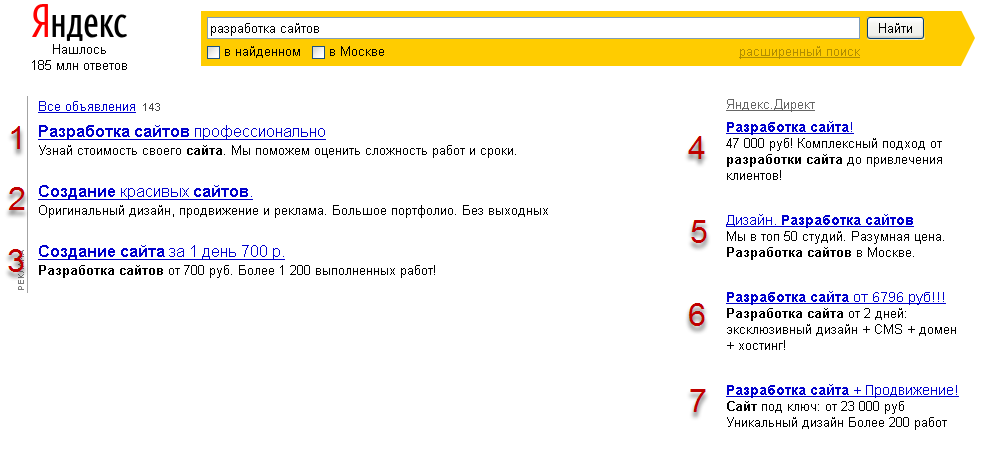

To show on the fingers - let's take a specific request from those in which there is high competition and high turnover of advertisers, for example, the mentioned “website development” . The issue of Yandex can change many times from the moment of publication of the article, so we will consider examples in the screenshots. To prevent anyone from making random advertisements (or anti-advertisements), the links and company names on all screenshots, as well as the entire search results, are removed. I have not visited any of the sites in the issue and analyze advertisers in the issuance of Direct only on external factors

We analyze the use of negative keywords by competitors.

This is the easiest. We take any garbage request from the semantic core of the request development sites. If you can not come up with a garbage request yourself - wordstat.yandex.ru to help you.

Companies 1,3,5 books obviously did not read and did not hear about negative words. They will not last long in this mode and will quickly merge budgets when any serious competitor appears. Companies 2,4,6,7 behave smarter.

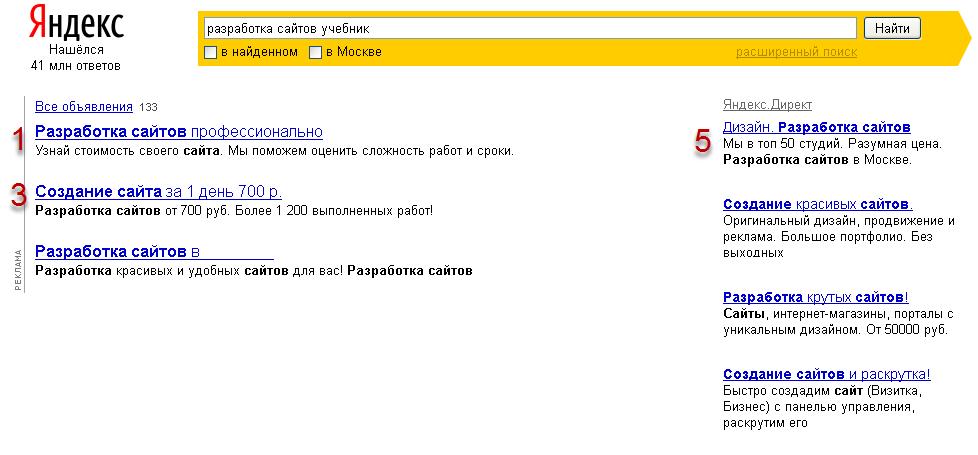

We analyze the use of quotes by competitors.

Everything is just as simple. We take crazy request from the ceiling with a deliberate zero frequency.

Advertisers 1,3,5 confirmed their membership in the suicide club. Advertiser 6 has a long footwoman in a campaign with negative keywords. Any non-obvious request (such as ours) lowers its CTR and increases the cost of a click. The error is not so fatal compared to previous advertisers, but also leads to increased budget spending. Advertisers 4 and 7 turned out to be the wisest of all, taking the quoted query - on the primary grounds with them it will be the most difficult to fight. More detailed information can be obtained by sorting the target requests and checking their presence in the issuance. Surely they are smart and careful, given their initially low positions on the initial request, they do not overheat the auction. Advertiser 2 has obviously chosen the following tactics - he broke this keyword into 2 separate requests a) a query in exact correspondence - with a high bid, b) a query with a long badge of negative keywords - with a low bid.

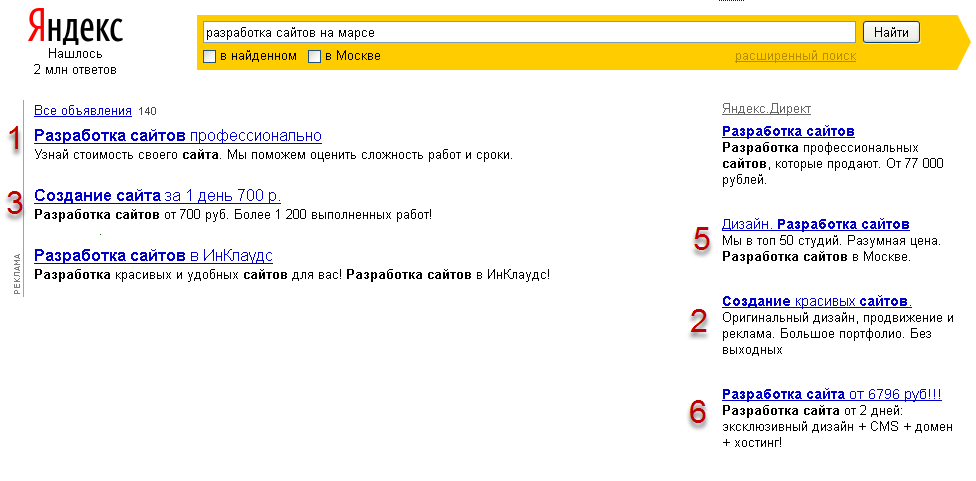

Find out geotargeting competitors.

Hostess note: when you click on a phrase in the budget estimator or in the interface of the RK, you can see all the competitors located on the overlapping phrases. Having found your competitors in this long cart, you can easily find out their geo-targeting.

If RK is fragmented into regions - this information will not help you, but a simple conclusion works here: if a competitor does not know about negative words, about such tricks as crushing RK - he is not even aware of it.

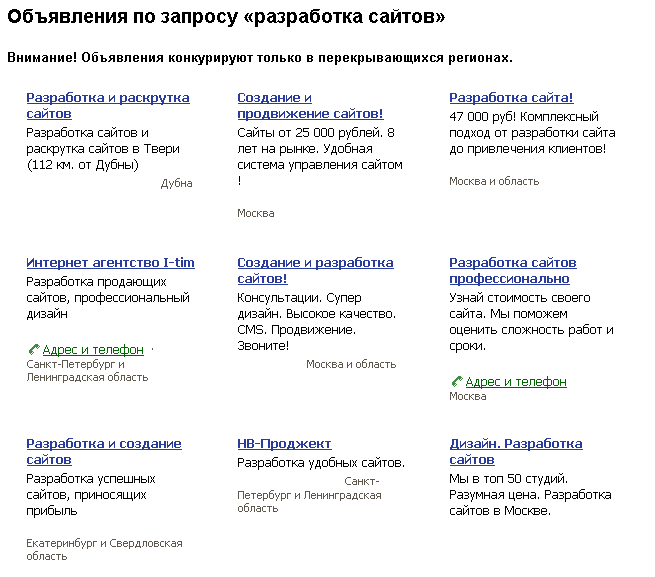

Find out the rates and CTR competitors

As you know, the algorithm for determining the position of a display in Yekaterinburg can be simplified as follows: who has the higher rate product and CTR - the higher is in the results. It turns out that we have an equation with two unknowns (the rate is (unknown) x CTR (also unknown) = position (known). It seems that there is no chance to get to the bottom of the truth.

However, take a look! Saving information lies behind the inconspicuous link "All ads"

If you carefully read the help - we will know that:

. . , .. .

BINGO! We can see all competitors in descending order of click price, excluding their CTR. Comparing the original issue with the issue on this page you can make a number of interesting and useful conclusions. Now, of course, we will not get exact figures (for evaluation, you need to launch your own RK in this category), but conclusions about relative rates and CTR of RK for all competitors on this request can be made. Roughly speaking - if on the issuing page you are in third position, and on the “all ads” page - for example, on the fifth, then your CTR is higher than that of the competitors that correspond to these positions, which is good. If, on the contrary, this is a sign that a part of the budget is being wasted, immediately start looking for the causes of a bad CTR.

By the way, with the accumulated CTR and the correct setting of the RC, you can enjoy the view of how your ad with a tiny rate is, how your ad with a tiny rate is placed in special accommodation , and competitors with bids ten times higher are trying to catch up with you ...

If you are not tired, you can analyze the width of the semantic core used in the Republic of Kazakhstan (general audience coverage), the use of synonyms, slang and misprints as queries, whether the advertisements for each LF query sharpens the use of robots to control the RC

The total information obtained as a result of such an analysis is quite enough for you to make the right decision on choosing a strategy for each competitor. Analysis of other factors will also be useful for making a decision: analyzing information on the office’s website, analyzing feedback from their clients, competitive intelligence data (a rather trivial ringing and communication with the manager). This is quite enough to get the most complete picture of the prospects of a competitor in the market.

Have a great battle!

Ps. I accept from habravchan applications for detailed probing competitors in any subject. The results will be published as a similar article.

Source: https://habr.com/ru/post/107790/

All Articles