Google (GOOG): third quarter 2010

Disclaimer: This post was written by me as a private person. This post is an experiment that I want to continue with the example of other IT companies. I wanted to understand many issues myself, but I had an idea to share it with others. I am not an expert in finance, comments will be extremely valuable!

This week, the traditional regular " call " of Google to its investors, in which the company shares its results for the recent period and answers questions, took place. As a public company, Google provides all the information in the open form, interested can see the recording of the call , slides and a press release with all the financial details. The call is a presentation from the company's financial director and key executives (this time was also the CEO Eric Schmidt), listeners are analysts of the largest financial institutions - Goldmahn Sachs, JPMorgan, Barclays, etc.

This week, the traditional regular " call " of Google to its investors, in which the company shares its results for the recent period and answers questions, took place. As a public company, Google provides all the information in the open form, interested can see the recording of the call , slides and a press release with all the financial details. The call is a presentation from the company's financial director and key executives (this time was also the CEO Eric Schmidt), listeners are analysts of the largest financial institutions - Goldmahn Sachs, JPMorgan, Barclays, etc.

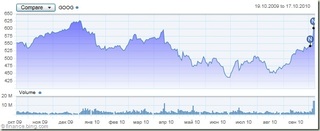

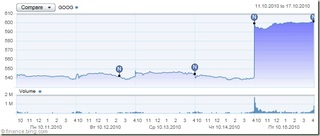

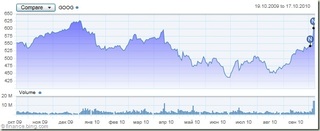

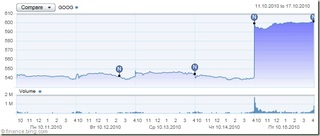

Undoubtedly, the third quarter of 2010 (Google’s fiscal year coincides with the calendar year) turned out to be impressive and also reflects the continuing large growth of the IT industry (I can, for example, recall Microsoft's record numbers in July of this year). At the same time, this was extremely important for the company itself, since the results of the second quarter turned out to be lower than analysts' forecasts, which was the reason for various kinds of reflections of specialists.

')

If we move to numbers, then revenue (revenue) for the quarter amounted to $ 7.3 billion , which is 23% higher than last year, and net income (net income) - $ 2.2 billion , higher than 32% a year earlier. As you can see, profit growth has seriously exceeded revenue growth, which seems very interesting. This happened despite the fact that development costs were rising, which seriously alarmed analysts in the last quarter. Let me remind you that a year ago there was still an active phase of the crisis, when compared with the second quarter of this year, profit growth was 7%.

I was curious to know that in terms of profit, the share of the United States is as much as 52% , Great Britain - about 11%, and all other countries combined - less than 40%. And the share of the United States has practically not changed in recent years. Therefore, one should not be surprised why American users always get everything among the first - this is not so much “American thinking” as a clean economy.

Despite impressive results, analysts asked a lot of questions (I recommend listening to a part of Q & A, which accounts for more than half of the entire audio recording). As you know, the last months of Google is under some pressure in search of the next billion - a source of income that can be on par with the main search. There is a very interesting CNNMoney article on this topic: “ Google: The search party is over ”. Answering these challenges, Google decided to start a conversation and, within the framework of the presentation, noted that a solution had already been found.

Three facts were noted. First, visual advertising (display ads) should generate $ 2.5 billion per year. Secondly, YouTube demonstrates 2 billion monetized hits. Thirdly, mobile advertising should bring $ 1 billion a year. Two of these three points were discussed with interest.

YouTube. After buying this service for $ 1.65 billion from the founders, Google has repeatedly tried to find the right monetization model. Advertising is an obvious direction, but the service requires a huge amount of processing the amount of traffic it generates. And if no one argues about the insane popularity of this site, which is the undisputed leader in the delivery of video content, then there are questions about its profitability. The analyst’s direct question about profitability was not answered. Google does not comment on this.

Android The number above is the total amount of mobile search. That is, on a variety of devices. Analysts are also constantly asking questions about the profitability of Android. Despite the large increase in the use of the platform, it does not directly bring money - Google distributes it for free, and in addition does not control the use of its own application store (unlike Apple and Microsoft with the new WP7). Nevertheless, the company is confident that mobile search is the future, and Android-based phones help in making profit in this direction. As for the stores, Eric Schmidt points out that this is an earning opportunity for developers, not for Google.

A few more facts that seemed to me extremely interesting during the answers to the questions:

It would be interesting to know your opinion on the information itself as a whole, and on the interest in such reviews.

This week, the traditional regular " call " of Google to its investors, in which the company shares its results for the recent period and answers questions, took place. As a public company, Google provides all the information in the open form, interested can see the recording of the call , slides and a press release with all the financial details. The call is a presentation from the company's financial director and key executives (this time was also the CEO Eric Schmidt), listeners are analysts of the largest financial institutions - Goldmahn Sachs, JPMorgan, Barclays, etc.

This week, the traditional regular " call " of Google to its investors, in which the company shares its results for the recent period and answers questions, took place. As a public company, Google provides all the information in the open form, interested can see the recording of the call , slides and a press release with all the financial details. The call is a presentation from the company's financial director and key executives (this time was also the CEO Eric Schmidt), listeners are analysts of the largest financial institutions - Goldmahn Sachs, JPMorgan, Barclays, etc.Undoubtedly, the third quarter of 2010 (Google’s fiscal year coincides with the calendar year) turned out to be impressive and also reflects the continuing large growth of the IT industry (I can, for example, recall Microsoft's record numbers in July of this year). At the same time, this was extremely important for the company itself, since the results of the second quarter turned out to be lower than analysts' forecasts, which was the reason for various kinds of reflections of specialists.

')

If we move to numbers, then revenue (revenue) for the quarter amounted to $ 7.3 billion , which is 23% higher than last year, and net income (net income) - $ 2.2 billion , higher than 32% a year earlier. As you can see, profit growth has seriously exceeded revenue growth, which seems very interesting. This happened despite the fact that development costs were rising, which seriously alarmed analysts in the last quarter. Let me remind you that a year ago there was still an active phase of the crisis, when compared with the second quarter of this year, profit growth was 7%.

I was curious to know that in terms of profit, the share of the United States is as much as 52% , Great Britain - about 11%, and all other countries combined - less than 40%. And the share of the United States has practically not changed in recent years. Therefore, one should not be surprised why American users always get everything among the first - this is not so much “American thinking” as a clean economy.

Despite impressive results, analysts asked a lot of questions (I recommend listening to a part of Q & A, which accounts for more than half of the entire audio recording). As you know, the last months of Google is under some pressure in search of the next billion - a source of income that can be on par with the main search. There is a very interesting CNNMoney article on this topic: “ Google: The search party is over ”. Answering these challenges, Google decided to start a conversation and, within the framework of the presentation, noted that a solution had already been found.

Three facts were noted. First, visual advertising (display ads) should generate $ 2.5 billion per year. Secondly, YouTube demonstrates 2 billion monetized hits. Thirdly, mobile advertising should bring $ 1 billion a year. Two of these three points were discussed with interest.

YouTube. After buying this service for $ 1.65 billion from the founders, Google has repeatedly tried to find the right monetization model. Advertising is an obvious direction, but the service requires a huge amount of processing the amount of traffic it generates. And if no one argues about the insane popularity of this site, which is the undisputed leader in the delivery of video content, then there are questions about its profitability. The analyst’s direct question about profitability was not answered. Google does not comment on this.

Android The number above is the total amount of mobile search. That is, on a variety of devices. Analysts are also constantly asking questions about the profitability of Android. Despite the large increase in the use of the platform, it does not directly bring money - Google distributes it for free, and in addition does not control the use of its own application store (unlike Apple and Microsoft with the new WP7). Nevertheless, the company is confident that mobile search is the future, and Android-based phones help in making profit in this direction. As for the stores, Eric Schmidt points out that this is an earning opportunity for developers, not for Google.

A few more facts that seemed to me extremely interesting during the answers to the questions:

- Google does not see the cannibalization of personal computers on the tablet side. It's complimentary not cannibalization. The growth in the use of tablets is, but it does not interfere with the PC

- The company is working on the sociality of its services, in particular in partnership with Twitter (Google, like Microsoft, pays Twitter for indexing their data). However, details are not disclosed.

- Latest statistics of 200,000 activated Android devices per day has not been updated.

- Instant Search (Google Instant Search) doesn’t have a strong effect on search returns. This is a large and long investment aimed at user convenience, but not at a strong increase in revenue. The appearance of an instant search on mobile devices can be expected in the fall, “which in California lasts longer than usual”

It would be interesting to know your opinion on the information itself as a whole, and on the interest in such reviews.

Source: https://habr.com/ru/post/106330/

All Articles